At Blossom Company, events and transactions during 2020 included the following. The tax rate for all...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

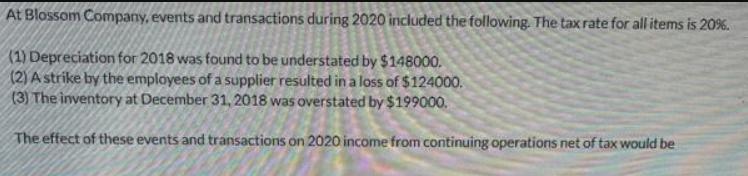

At Blossom Company, events and transactions during 2020 included the following. The tax rate for all items is 20%. (1) Depreciation for 2018 was found to be understated by $148000. (2) A strike by the employees of a supplier resulted in a loss of $124000. (3) The inventory at December 31, 2018 was overstated by $199000. The effect of these events and transactions on 2020 income from continuing operations net of tax would be ($277600). ($376800). ($217600). ($99200). At Blossom Company, events and transactions during 2020 included the following. The tax rate for all items is 20%. (1) Depreciation for 2018 was found to be understated by $148000. (2) A strike by the employees of a supplier resulted in a loss of $124000. (3) The inventory at December 31, 2018 was overstated by $199000. The effect of these events and transactions on 2020 income from continuing operations net of tax would be ($277600). ($376800). ($217600). ($99200).

Expert Answer:

Answer rating: 100% (QA)

The detailed answer for the above question is provided below PARTICULRS AMOUNT A strike by th... View the full answer

Related Book For

Intermediate Accounting

ISBN: 978-0077400163

6th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson

Posted Date:

Students also viewed these accounting questions

-

For 2014, Silvertip Construction, Inc., reported income from continuing operations (after tax) of $1,650,000 before considering the following information. On November 15, 2014, the company adopted a...

-

The Alley Company has income from continuing operations of $490,000 for the year ended December 31, 2007. It also has the following items (before considering income taxes): (1) An extraordinary fire...

-

The Omega Company reports the following: Income from continuing operations $1,000.000Extraordinary item 3,000,000Net income $4.000.000 Shares outstanding: For basic EPS 1,000,000For diluted EPS...

-

Question 2 A company manufactures and sells x units of audio system per month. The cost function and the price function (in RM) are given as below. Cost: C(x) = 40,000 + 600 x Price: p(x) = 3,000 -...

-

Consider the $2-per-month tax on Internet access in Problem 6-9. Suppose that in the market for Internet access services provided to households, the market price increases by $2 per month after the...

-

An 85-mi trip to the beach took Susan 2 hr. During the second hour, a rainstorm caused her to average 7 mph less than she traveled during the first hour. Find her average rate for the first hour.

-

10, or 20 years. How does the bond yield change with time to maturity?

-

Software Distributors reports net income of $65,000. Included in that number is depreciation expense of $15,000 and a loss on the sale of land of $6,000. A comparison of this years and last years...

-

Art Neuner, an investor in real estate, bought an office condominium. The market value of the condo was $210,000 with a 70% assessment rate. Art feels that his return should be 12% per month on his...

-

Mercier Manufacturing produces a plastic part in three sequential departments: Extruding, Fabricating, and Packaging. Mercier uses the weighted-average process costing method to account for costs of...

-

I need help with the week 3 assignment 1.Parenthetical Citation 2.Identify the main concepts; often the "keywords" are helpful for identifying main concepts 3.Provide the research question(s) and/or...

-

Archer Contracting repaved 50 miles of two-lane county roadway with a crew of six employees. This crew worked 8 days and used \($7,000\) worth of paving material. Nearby, Bronson Construction repaved...

-

An insurance company has the following profitability analysis of its services: The fixed costs are distributed equally among the services and are not avoidable if one of the services is dropped. What...

-

The Scantron Company makes bar-code scanners for major supermarkets. The sales staff estimates that the company will sell 500 units next year for 10,000 each. The production manager estimates that...

-

Determine the following: a. The stockholders equity of a company that has assets of \(\$ 625,000\) and liabilities of \(\$ 310,000\). b. The retained earnings of a company that has assets of \(\$...

-

You are the manager of internal audit for Do-It-All, Ltd., a large, diversified, decentralized manufacturing company. Over the past two years, the information systems function in Do-It-All has...

-

PLEASE ONLY HELP WITH PART 5 OF THE QUESTION!!! Direct Materials, Direct Labor, and Overhead Variances, Journal Entries Algers Company produces dry fertilizer. At the beginning of the year, Algers...

-

A company pledges their receivables so they may Multiple Choice Charge a factoring fee. Increase sales. Recognize a sale. Collect a pledge fee. Borrow money. Failure by a promissory notes' maker to...

-

The cloudy afternoon mirrored the mood of the conference of division managers. Claude Meyer, assistant to the controller for Hunt Manufacturing, wore one of the gloomy faces that were just emerging...

-

How are discontinued operations reported in the income statement?

-

JWS Transport Companys employees earn vacation time at the rate of 1 hour per 40-hour work period. The vacation pay vests immediately (that is, an employee is entitled to the pay even if employment...

-

Think of a firm that successfully achieved a combination overall cost leadership and differentiation strategy. What can be learned from this example? Are the advantages sustainable? Why? Why not?...

-

Web-based exercise. Search the Web for a recent poll in which the sample statistic is a proportion, for example, the proportion in the sample responding Yes to a question. Calculate a 95% confidence...

-

A sampling distribution, continued. Exercise 21.33 presents 50 sample means x from 50 random samples of size 100. Using a calculator, find the mean and standard deviation of these 50 values. Then...

Study smarter with the SolutionInn App