Question: At Dec. 31, EA Co. estimates total bad debts that will become uncollectible in the future as $60,000. The existing balance in the allowance for

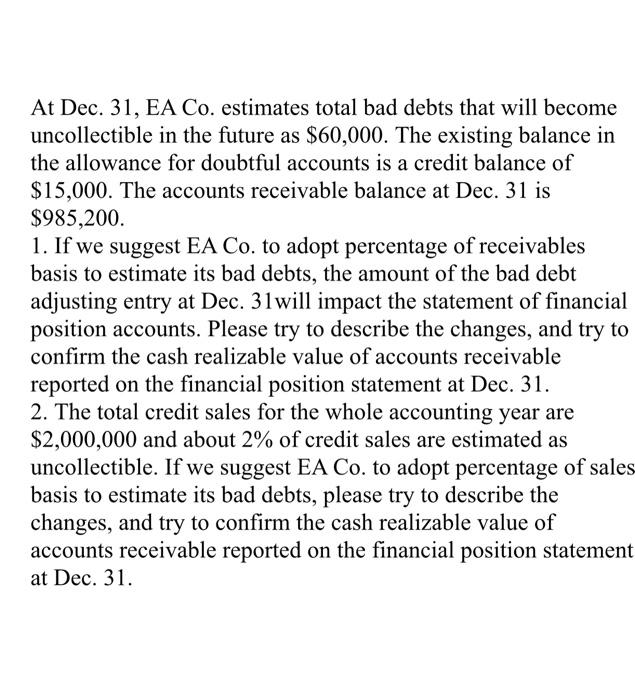

At Dec. 31, EA Co. estimates total bad debts that will become uncollectible in the future as $60,000. The existing balance in the allowance for doubtful accounts is a credit balance of $15,000. The accounts receivable balance at Dec. 31 is $985,200.

1. If we suggest EA Co. to adopt percentage of receivables basis to estimate its bad debts, the amount of the bad debt adjusting entry at Dec. 31will impact the statement of financial position accounts. Please try to describe the changes, and try to confirm the cash realizable value of accounts receivable reported on the financial position statement at Dec. 31.

2. The total credit sales for the whole accounting year are $2,000,000 and about 2% of credit sales are estimated as uncollectible. If we suggest EA Co. to adopt percentage of sales basis to estimate its bad debts, please try to describe the changes, and try to confirm the cash realizable value of accounts receivable reported on the financial position statement at Dec. 31.

At Dec. 31, EA Co. estimates total bad debts that will become uncollectible in the future as $60,000. The existing balance in the allowance for doubtful accounts is a credit balance of $15,000. The accounts receivable balance at Dec. 31 is $985,200. 1. If we suggest EA Co. to adopt percentage of receivables basis to estimate its bad debts, the amount of the bad debt adjusting entry at Dec. 31 will impact the statement of financial position accounts. Please try to describe the changes, and try to confirm the cash realizable value of accounts receivable reported on the financial position statement at Dec. 31. 2. The total credit sales for the whole accounting year are $2,000,000 and about 2% of credit sales are estimated as uncollectible. If we suggest EA Co. to adopt percentage of sales basis to estimate its bad debts, please try to describe the changes, and try to confirm the cash realizable value of accounts receivable reported on the financial position statement at Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts