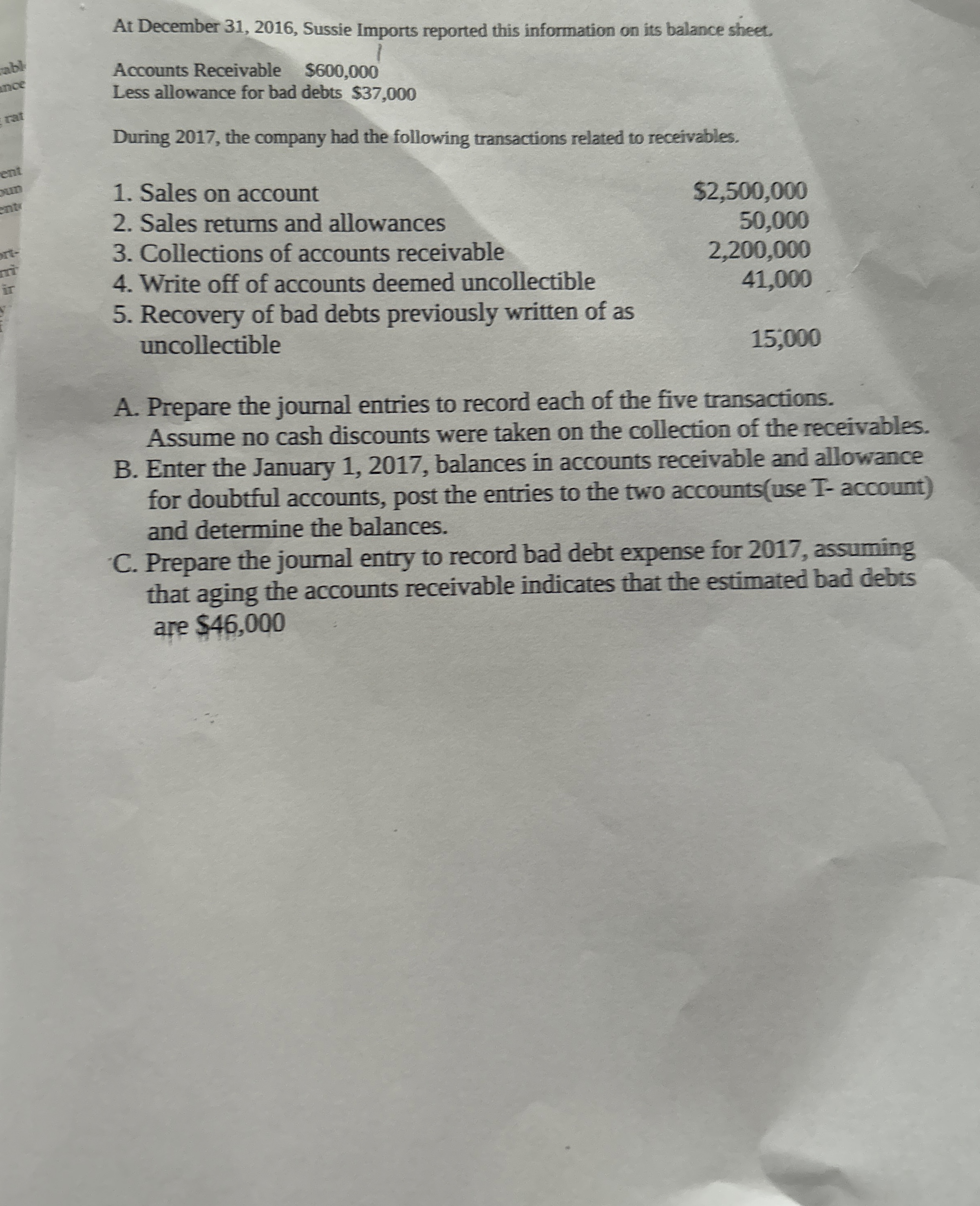

Question: At December 3 1 , 2 0 1 6 , Sussie Imports reported this information on its balance sheet. Accounts Receivable $ 6 0 0

At December Sussie Imports reported this information on its balance sheet.

Accounts Receivable $

Less allowance for bad debts $

During the company had the following transactions related to receivables.

Sales on account

Sales returns and allowances

Collections of accounts receivable

Write off of accounts deemed uncollectible

$

Recovery of bad debts previously written of as uncollectible

A Prepare the journal entries to record each of the five transactions. Assume no cash discounts were taken on the collection of the receivables.

B Enter the January balances in accounts receivable and allowance for doubtful accounts, post the entries to the two accountsuse I account and determine the balances.

C Prepare the joumal entry to record bad debt expense for assuming that aging the accounts receivable indicates that the estimated bad debts are $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock