Question: At December 3 1 , 2 0 2 5 , Pina Corporation has a deferred tax asset of ( $ 2 0 4

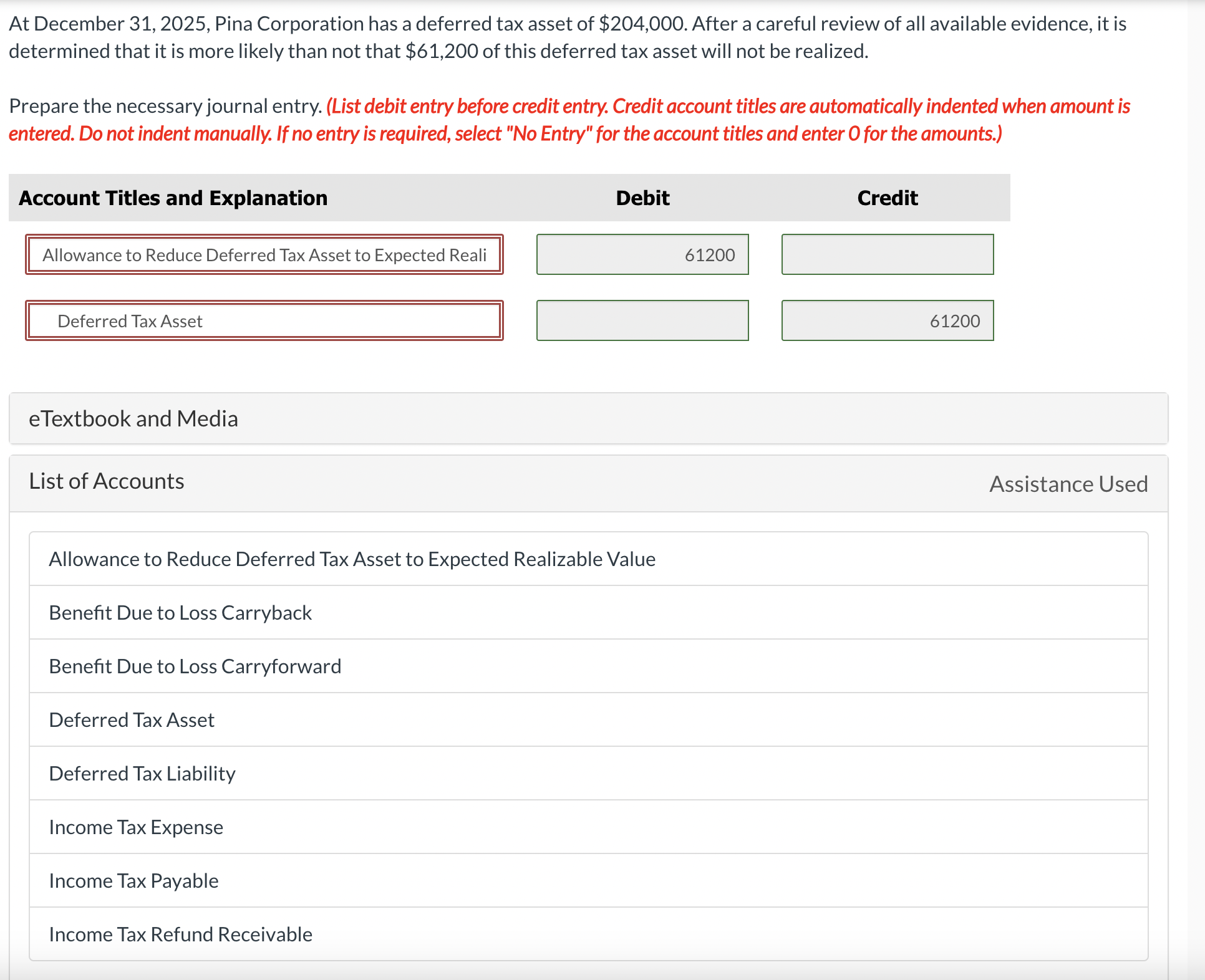

At December Pina Corporation has a deferred tax asset of $ After a careful review of all available evidence, it is determined that it is more likely than not that $ of this deferred tax asset will not be realized. Prepare the necessary journal entry. List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. Account Titles and Explanation Debit Credit Allowance to Reduce Deferred Tax Asset to Expected Reali Deferred Tax Asset eTextbook and Media Allowance to Reduce Deferred Tax Asset to Expected Realizable Value Benefit Due to Loss Carryback Benefit Due to Loss Carryforward Deferred Tax Asset Deferred Tax Liability Income Tax Expense Income Tax Payable Income Tax Refund Receivable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock