Question: At first, please focus on the practical question and the decision tree uploaded for the practical question. Then, please focus on class activity and draw

At first, please focus on the practical question and the decision tree uploaded for the practical question. Then, please focus on class activity and draw and solve the decision tree for the class activity

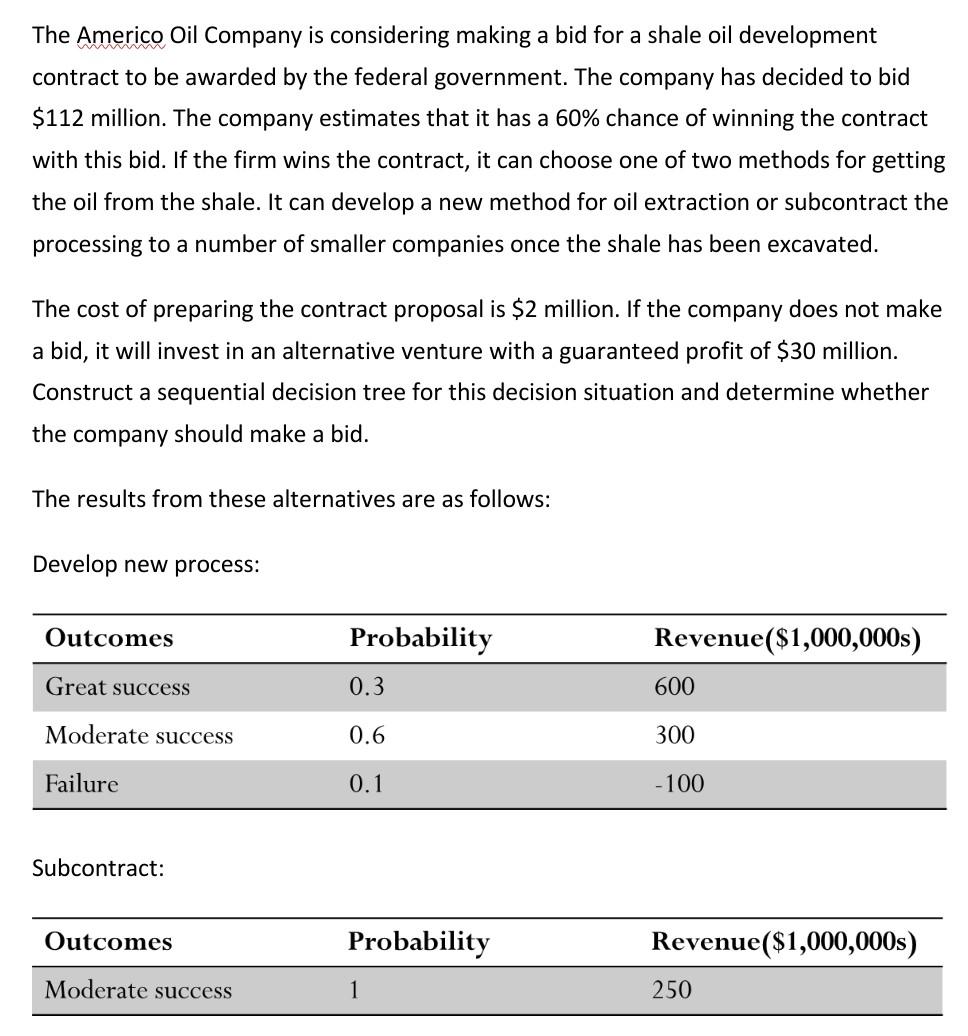

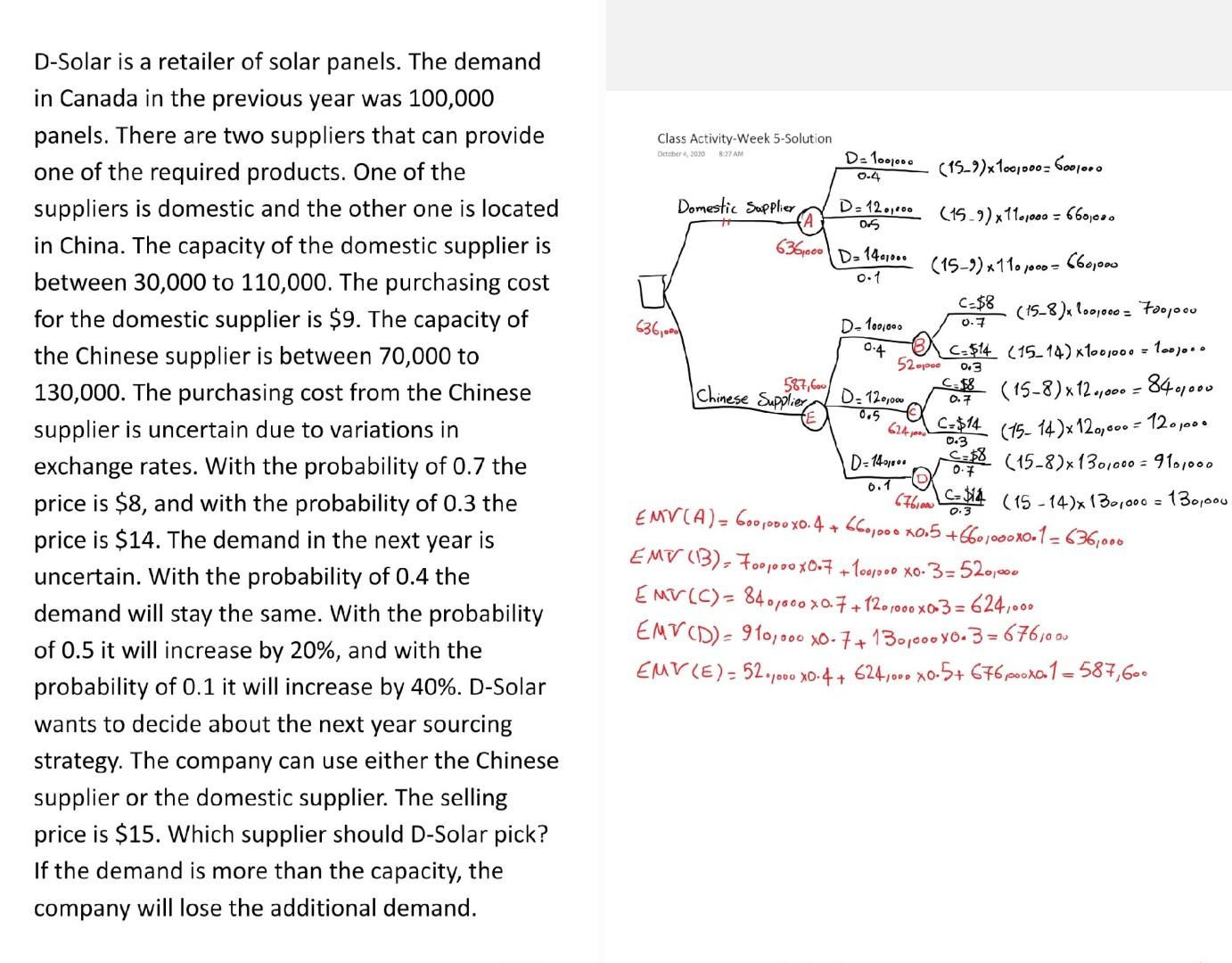

The Americo Oil Company is considering making a bid for a shale oil development contract to be awarded by the federal government. The company has decided to bid $112 million. The company estimates that it has a 60% chance of winning the contract with this bid. If the firm wins the contract, it can choose one of two methods for getting the oil from the shale. It can develop a new method for oil extraction or subcontract the processing to a number of smaller companies once the shale has been excavated. The cost of preparing the contract proposal is $2 million. If the company does not make a bid, it will invest in an alternative venture with a guaranteed profit of $30 million. Construct a sequential decision tree for this decision situation and determine whether the company should make a bid. The results from these alternatives are as follows: Develop new process: Subcontract: D-Solar is a retailer of solar panels. The demand in Canada in the previous year was 100,000 panels. There are two suppliers that can provide one of the required products. One of the suppliers is domestic and the other one is located in China. The capacity of the domestic supplier is between 30,000 to 110,000 . The purchasing cost for the domestic supplier is $9. The capacity of the Chinese supplier is between 70,000 to 130,000 . The purchasing cost from the Chinese supplier is uncertain due to variations in exchange rates. With the probability of 0.7 the price is $8, and with the probability of 0.3 the price is $14. The demand in the next year is uncertain. With the probability of 0.4 the EMV(B)=70010000.7+10000000.3=520,000 demand will stay the same. With the probability of 0.5 it will increase by 20%, and with the probability of 0.1 it will increase by 40%. D-Solar wants to decide about the next year sourcing strategy. The company can use either the Chinese supplier or the domestic supplier. The selling price is $15. Which supplier should D-Solar pick? If the demand is more than the capacity, the company will lose the additional demand

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock