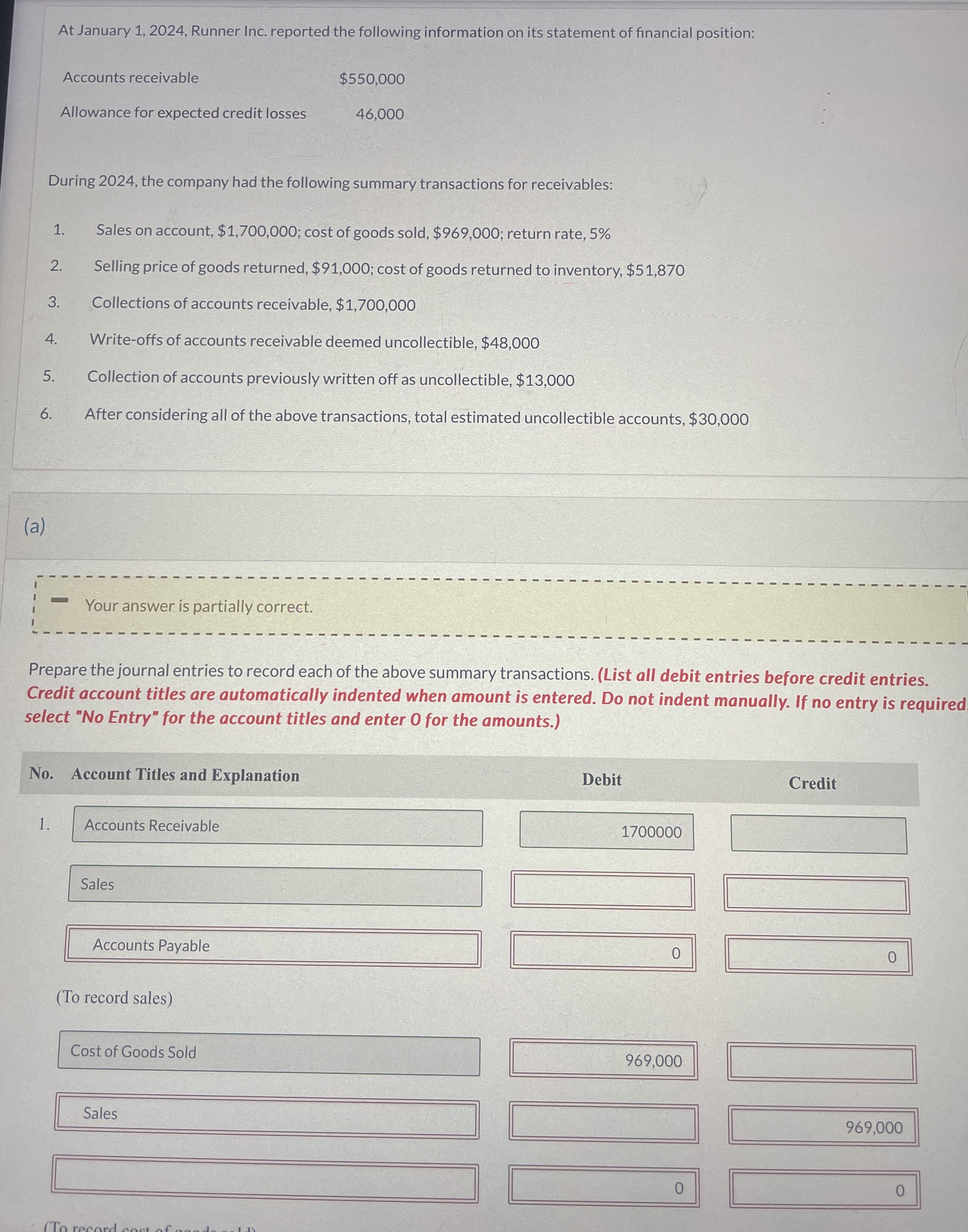

Question: At January 1 , 2 0 2 4 , Runner Inc. reported the following information on its statement of financial position: Accounts receivable $ 5

At January Runner Inc. reported the following information on its statement of financial position:

Accounts receivable

$

Allowance for expected credit losses

During the company had the following summary transactions for receivables:

Sales on account, $; cost of goods sold, $; return rate,

Selling price of goods returned, $; cost of goods returned to inventory, $

Collections of accounts receivable, $

Writeoffs of accounts receivable deemed uncollectible, $

Collection of accounts previously written off as uncollectible, $

After considering all of the above transactions, total estimated uncollectible accounts, $

a

Your answer is partially correct.

Prepare the journal entries to record each of the above summary transactions. List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required select No Entry" for the account titles and enter for the amounts.

No Account Titles and Explanation

Debit

Credit

To record sales

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock