Question: At one point, some Treasury bonds were callable. Consider the prices on the following three Treasury issues as of May 15, 2016: 6.70 May 20

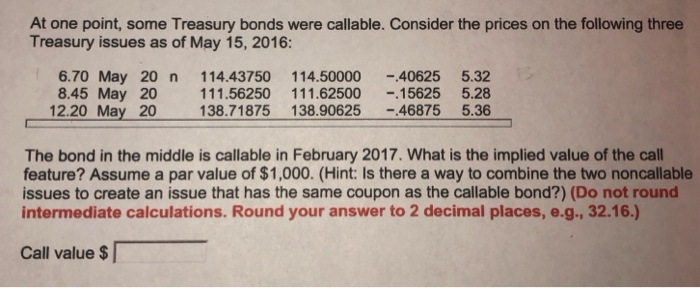

At one point, some Treasury bonds were callable. Consider the prices on the following three Treasury issues as of May 15, 2016: 6.70 May 20 n 114.43750 114.50000-40625 5.32 8.45 May 20 111.56250 111.62500.15625 5.28 12.20 May 20 138.71875 138.90625 46875 5.36 The bond in the middle is callable in February 2017. What is the implied value of the call feature? Assume a par value of $1,000. (Hint: Is there a way to combine the two noncallable issues to create an issue that has the same coupon as the callable bond?) (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Call value At one point, some Treasury bonds were callable. Consider the prices on the following three Treasury issues as of May 15, 2016: 6.70 May 20 n 114.43750 114.50000-40625 5.32 8.45 May 20 111.56250 111.62500.15625 5.28 12.20 May 20 138.71875 138.90625 46875 5.36 The bond in the middle is callable in February 2017. What is the implied value of the call feature? Assume a par value of $1,000. (Hint: Is there a way to combine the two noncallable issues to create an issue that has the same coupon as the callable bond?) (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Call value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts