At the end of 2021, ABC company had total sales $22 million. They had 1.3 million...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

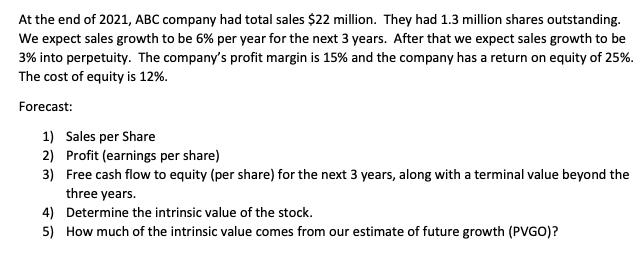

At the end of 2021, ABC company had total sales $22 million. They had 1.3 million shares outstanding. We expect sales growth to be 6% per year for the next 3 years. After that we expect sales growth to be 3% into perpetuity. The company's profit margin is 15% and the company has a return on equity of 25%. The cost of equity is 12%. Forecast: 1) Sales per Share 2) Profit (earnings per share) 3) Free cash flow to equity (per share) for the next 3 years, along with a terminal value beyond the three years. 4) Determine the intrinsic value of the stock. 5) How much of the intrinsic value comes from our estimate of future growth (PVGO)? At the end of 2021, ABC company had total sales $22 million. They had 1.3 million shares outstanding. We expect sales growth to be 6% per year for the next 3 years. After that we expect sales growth to be 3% into perpetuity. The company's profit margin is 15% and the company has a return on equity of 25%. The cost of equity is 12%. Forecast: 1) Sales per Share 2) Profit (earnings per share) 3) Free cash flow to equity (per share) for the next 3 years, along with a terminal value beyond the three years. 4) Determine the intrinsic value of the stock. 5) How much of the intrinsic value comes from our estimate of future growth (PVGO)?

Expert Answer:

Answer rating: 100% (QA)

Sales per Share Sales per Share Total Sales Number of Shares Outstanding Sales per Share 22000000 1300000 Sales per Share 1692 Profit Earnings per Sha... View the full answer

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780135811603

5th Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Posted Date:

Students also viewed these finance questions

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Identify each of the following items relating to sections of a balance sheet as Current Assets (CA), Property and Equipment (PE), Current Liabilities (CL), Long-Term Liabilities (LTL), or Owners...

-

A 25-MVA, 11.5 kV synchronous machines is operating as a synchronous condenser, as discussed in Appendix D (section D.4.1). The generator short-circuit ratio is 1.68 and the field current at rated...

-

Based on past experience, Maas Corp. (a U.S.-based company) expects to purchase raw materials from a foreign supplier at a cost of 1,000,000 francs on March 15, 2024. To hedge this forecasted...

-

What information should the independent auditor consider when assessing the competence of the internal auditors?

-

Springfield Corporation operates on a calendar-year basis. It begins the annual budgeting process in late August, when the president establishes targets for total sales dollars and net operating...

-

Give some examples of how restaurants or hotels use the concepts of demand elasticity, price discrimination, yield management, or price bundling in their pricing strategy?

-

Unicom is a regulated utility serving Northern Illinois. The following table lists the stock prices and dividends on Unicom from 1989 to 1998. a. Estimate the average annual return you would have...

-

Consider the thermal decomposition of a 41.6 g calcium carbonate (CaCO, molar mass 100.1 g/mol) sample in a cylinder with a movable piston: CaCO3(s) ---> CaO(s) + CO2(g). View the cylinder with the...

-

Exactly 3 firms are competing by simultaneously choosing quantity in a market. Each firm has the long run cost function of C, (q) = 10q,. Inverse market demand is PD (Q) = 180-2Q where Q=q1+ q2 + 93....

-

What is the difference between actual results and budgeted? Explain in details.

-

A 32-year-old woman attends the Genito-urinary Medicine (GUM) Clinic. She is concerned about vaginal discharge with an unpleasant smell. She has noticed these symptoms for the past 3 weeks and has...

-

Month Maintenance Costs Machine Hours Health Insurance Number of Employees Shipping Costs Units Shipped January $ 4 , 5 1 0 1 7 0 $ 8 , 5 7 0 6 3 $ 2 8 , 2 4 0 7 , 0 6 0 February $ 4 , 4 7 3 1 1 0 $...

-

GUSAC is the annual cultural festival and is the most anticipated cultural festival of Maharastra. Started in 2015, GUSAC '21 is the sixth edition. Why do you want to be part of this team? What...

-

Novak's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct),...

-

Based on the scenario described below, generate all possible association rules with values for confidence, support (for dependent), and lift. Submit your solutions in a Word document (name it...

-

Assume Gillette Corporation will pay an annual dividend of $0.65 one year from now. Analysts expect this dividend to grow at 12% per year thereafter until the fifth year. After then, growth will...

-

You are offered the right to receive $1000 per year forever, starting in one year. If your discount rate is 5%, what is this offer worth to you?

-

What is the difference between pledging accounts receivable to secure a loan and factoring accounts receivable? What types of short-term secured financing can a firm use to cover shortfalls?

-

Consider the following observations: a. Fit the nonlinear regression model \[ y=\theta_{1} e^{\theta_{2} x}+\varepsilon \] to these data. Discuss how you obtained the starting values. b. Test for...

-

Reconsider the regression models in Problem 12.6, parts a-e. Suppose the error terms in these models were multiplicative, not additive. Rework the problem under this new assumption regarding the...

-

For the models shown below, determine whether it is a linear model, an intrinsically linear model, or a nonlinear model. If the model is intrinsically linear, show how it can be linearized by a...

Study smarter with the SolutionInn App