Question: At the end of Year o Jarrett Corp. developed the following forecasts of net income: Forecasted Year Net Income Year 1 $20,856 Year 2

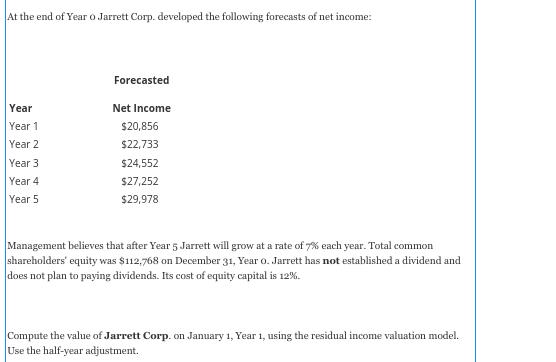

At the end of Year o Jarrett Corp. developed the following forecasts of net income: Forecasted Year Net Income Year 1 $20,856 Year 2 $22,733 Year 3 $24,552 Year 4 $27,252 Year 5 $29,978 Management believes that after Year 5 Jarrett will grow at a rate of 7% each year. Total common shareholders' equity was $112,768 on December 31, Year 0. Jarrett has not established a dividend and does not plan to paying dividends. Its cost of equity capital is 12%. Compute the value of Jarrett Corp. on January 1, Year 1, using the residual income valuation model. Use the half-year adjustment.

Step by Step Solution

There are 3 Steps involved in it

To compute the value of Jarrett Corp on January 1 Year 1 using the residual income valuation model we need to follow these steps 1 Calculate the expec... View full answer

Get step-by-step solutions from verified subject matter experts