Question: At time t=0, Rg= 10%, R= 10%, and E$/ -E $/ = 1. Assume that due to a sudden change in preferences, aggregate money demand

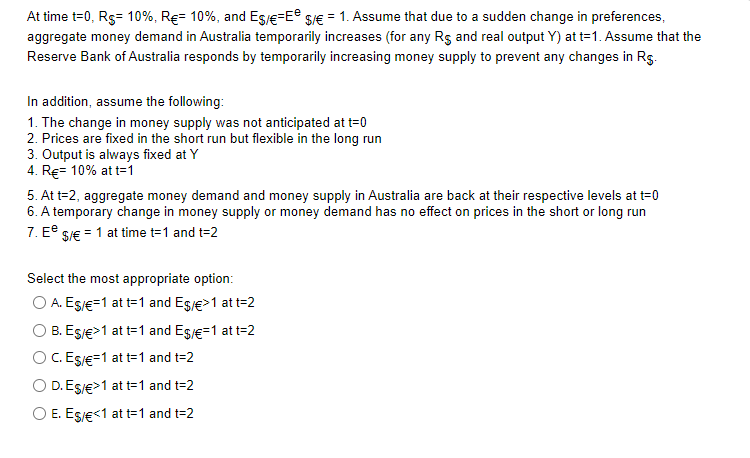

At time t=0, Rg= 10%, R= 10%, and E$/ -E $/ = 1. Assume that due to a sudden change in preferences, aggregate money demand in Australia temporarily increases (for any Rs and real output Y) at t=1. Assume that the Reserve Bank of Australia responds by temporarily increasing money supply to prevent any changes in R$. In addition, assume the following: 1. The change in money supply was not anticipated at t=0 2. Prices are fixed in the short run but flexible in the long run 3. Output is always fixed at Y 4. R= 10% at t=1 5. At t=2, aggregate money demand and money supply in Australia are back at their respective levels at t=0 6. A temporary change in money supply or money demand has no effect on prices in the short or long run 7. E $/ = 1 at time t=1 and t=2 Select the most appropriate option: O A. ES/ 1 at t= 1 and E$/ >1 at t=2 B. Es/>1 at t=1 and Eg/=1 at t=2 O C. Es/=1 at t= 1 and t=2 O D.ES/>1 at t=1 and t=2 O E. Es/1 at t=2 B. Es/>1 at t=1 and Eg/=1 at t=2 O C. Es/=1 at t= 1 and t=2 O D.ES/>1 at t=1 and t=2 O E. Es/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts