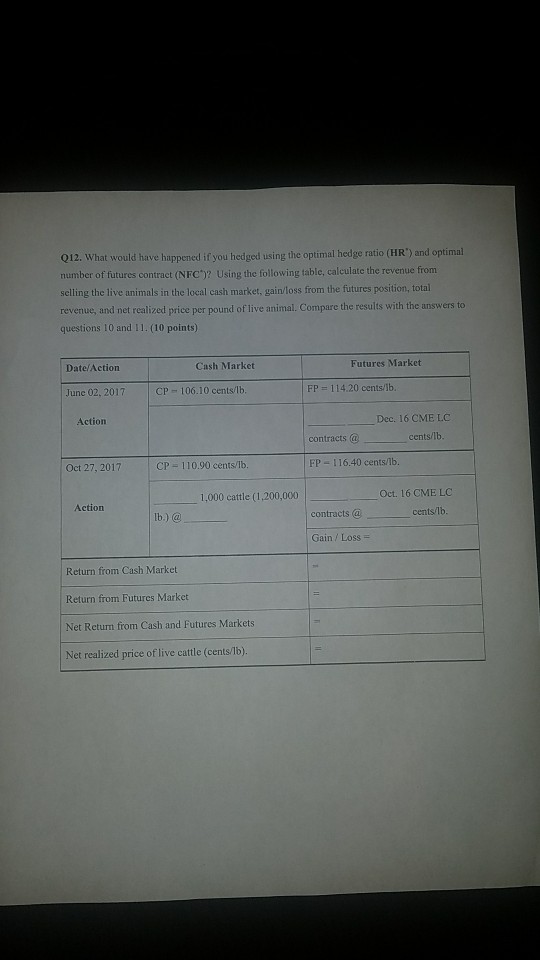

Question: at would have happened if you hedged using the optimal hedge ratio (HR') and optimal number of futures contract (NFC)? Using the following table, calculate

at would have happened if you hedged using the optimal hedge ratio (HR') and optimal number of futures contract (NFC)? Using the following table, calculate the revenue from revenue, and net realized price per pound of live animal. Compare the results with the answers to questions 10 and 11. (10 points) Date Actiorn Cash Market Futures Market FP 114.20 cents/lb. June 02, 2017 CP 106.10 cents/lb Action Dec. 16 CME LC contracts C@ cents/lb. Oct 27, 2017 CP 110.90 cents/lb FP 116.40 cents/lb. 1,000 cattle (1,200,000 Action cents lb lb.) @ Gain/ Loss Return from Cash Market Return from Futures Market Net Rctun from Cash and Futures Markets Net realized price of live cattle (cents/lb). at would have happened if you hedged using the optimal hedge ratio (HR') and optimal number of futures contract (NFC)? Using the following table, calculate the revenue from revenue, and net realized price per pound of live animal. Compare the results with the answers to questions 10 and 11. (10 points) Date Actiorn Cash Market Futures Market FP 114.20 cents/lb. June 02, 2017 CP 106.10 cents/lb Action Dec. 16 CME LC contracts C@ cents/lb. Oct 27, 2017 CP 110.90 cents/lb FP 116.40 cents/lb. 1,000 cattle (1,200,000 Action cents lb lb.) @ Gain/ Loss Return from Cash Market Return from Futures Market Net Rctun from Cash and Futures Markets Net realized price of live cattle (cents/lb)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts