Question: At year - end, Blake sells his ( 1 / 3 ) interest in the ABC Partnership to Gwen for (

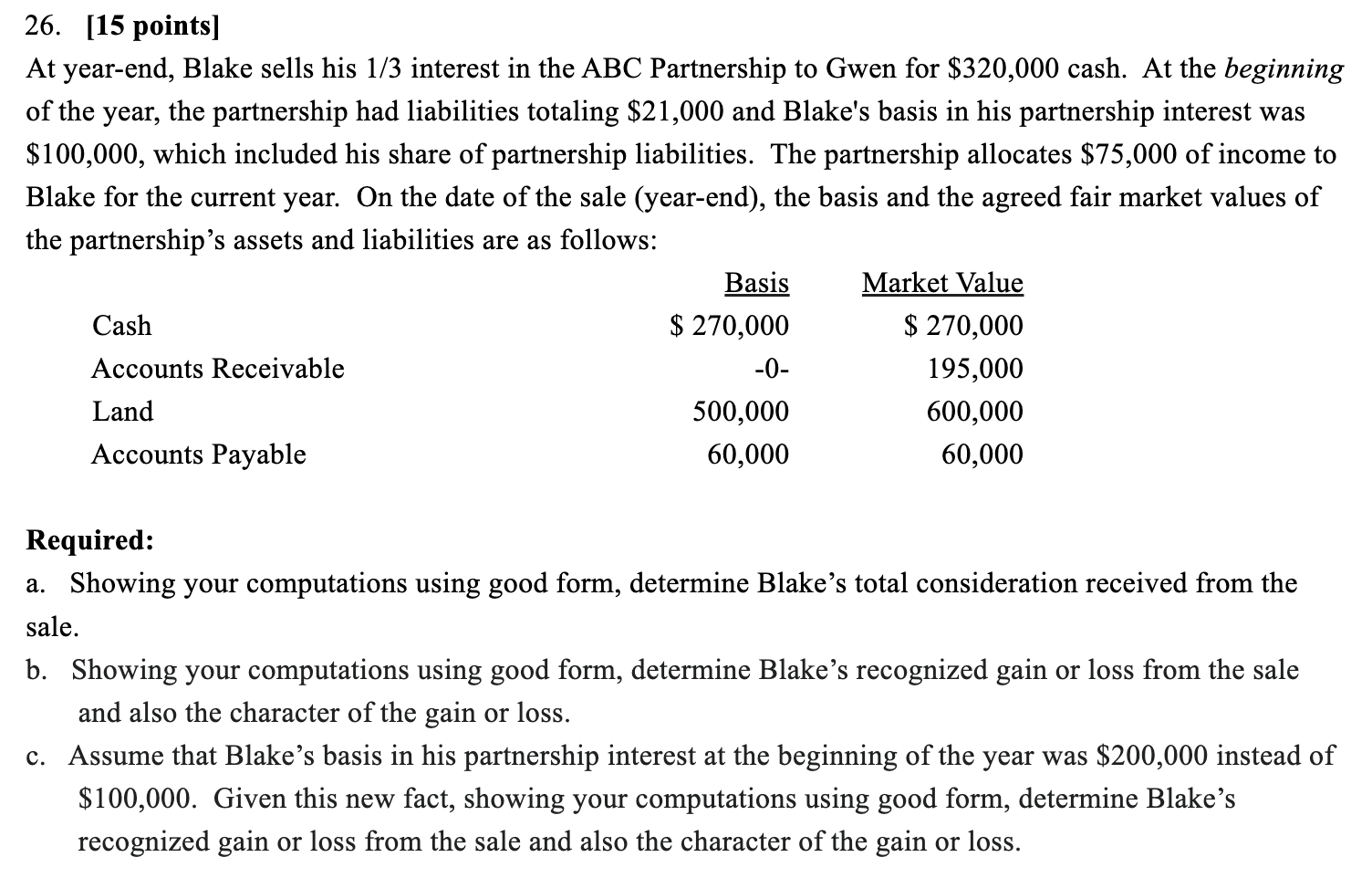

At yearend, Blake sells his interest in the ABC Partnership to Gwen for $ cash. At the beginning of the year, the partnership had liabilities totaling $ and Blake's basis in his partnership interest was $ which included his share of partnership liabilities. The partnership allocates $ of income to Blake for the current year. On the date of the sale yearend the basis and the agreed fair market values of the partnership's assets and liabilities are as follows: Required: a Showing your computations using good form, determine Blake's total consideration received from the sale. b Showing your computations using good form, determine Blake's recognized gain or loss from the sale and also the character of the gain or loss. c Assume that Blake's basis in his partnership interest at the beginning of the year was $ instead of $ Given this new fact, showing your computations using good form, determine Blake's recognized gain or loss from the sale and also the character of the gain or loss.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock