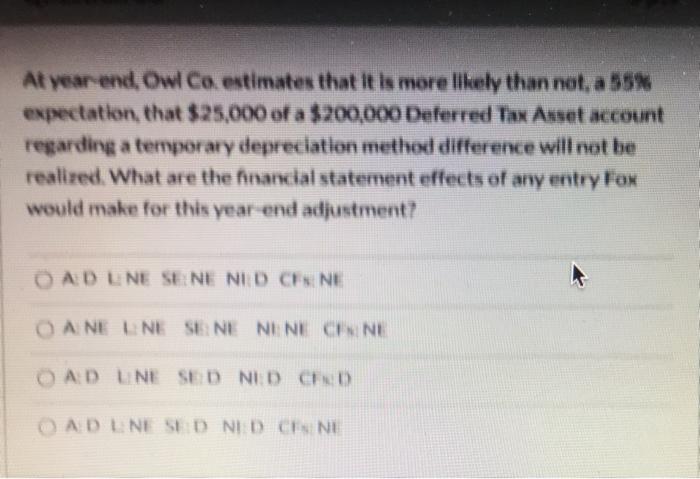

Question: At year end, Owl Ce estimates that it is more likely than not, a 55 expectation, that $25,000 of a $200,000 Deferred Tax Asset account

At year end, Owl Ce estimates that it is more likely than not, a 55 expectation, that $25,000 of a $200,000 Deferred Tax Asset account regarding a temporary depreciation method difference will not be realived. What are the financial statement effects of any entry Fox would make for this year end adjustment? OAD NE SE NE NID CENNE O A NE LINE SE NE NINE CENE OAD LINE SED NID CEND AD LINE SED NID CEN NE

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock