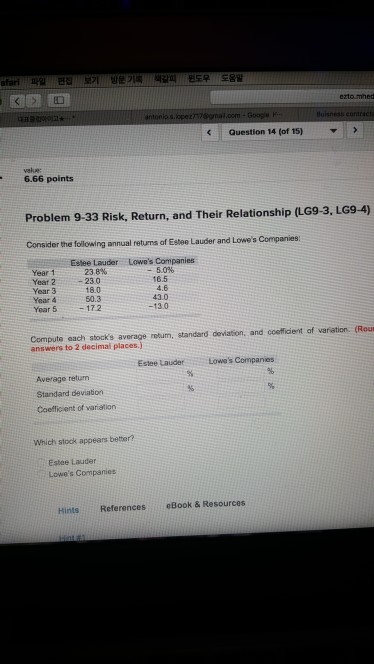

Question: atari: ea E Question 14 (of 15) vake 6.66 points Problem 9-33 Risk, Return, and Their Relationship (LG9-3, LG9-4) Consider the folowing annual returns of

atari: ea E Question 14 (of 15) vake 6.66 points Problem 9-33 Risk, Return, and Their Relationship (LG9-3, LG9-4) Consider the folowing annual returns of Estee Lauder and Lowe's Companies: Year 1 Yeat 2 Year 3 Year 4 Year 5 Estee Lauder 23.8% 230 18.0 50.3 172 Lowe's Companies 5.0% 16.5 4.6 43.0 -13.0 Compute each stocks average retum, standard deviation, and coefficient of variation (Rou answers to 2 decimal places.) Estee LauderLowe's Companies Average return Standard deviation Coefficient of variation Which stock appears better? Estee Lauder Hints References eBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts