Question: A-TEEM $ * 4*** ***** Pricing Floating-Rate and Inverse-Floating Rate Securities (continued) >The coupon rate of a floating-rate security (or floater) = reference rate +

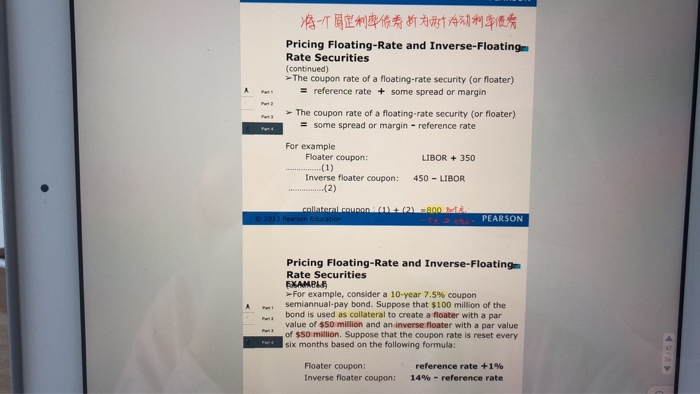

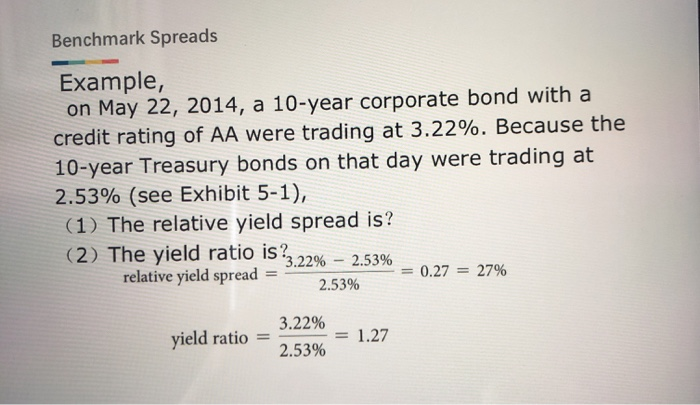

A-TEEM $ * 4*** ***** Pricing Floating-Rate and Inverse-Floating Rate Securities (continued) >The coupon rate of a floating-rate security (or floater) = reference rate + some spread or margin > The coupon rate of a floating-rate security (or floater) = some spread or margin-reference rate LIBOR + 350 For example Floater coupon: (1) Inverse floater coupon: ..........(2) 450 - LIBOR collater. RANA (2.900 2013 Pearson Education PEARSON Pricing Floating-Rate and Inverse-Floating Rate Securities EXAMPLE For example, consider a 10-year 7.5% coupon semiannual-pay bond. Suppose that $100 million of the bond is used as collateral to create a floater with a par value of $50 million and an inverse floater with a par value of $50 million. Suppose that the coupon rate is reset every six months based on the following formula: Floater coupon Inverse floater coupon: reference rate +1% 14% - reference rate Benchmark Spreads Example, on May 22, 2014, a 10-year corporate bond with a credit rating of AA were trading at 3.22%. Because the 10-year Treasury bonds on that day were trading at 2.53% (see Exhibit 5-1), (1) The relative yield spread is? (2) The yield ratio is? *3.22% 2.53% relative yield spread 0.27 = 27% 2.53% yield ratio 3.22% 2.53% 1.27 A-TEEM $ * 4*** ***** Pricing Floating-Rate and Inverse-Floating Rate Securities (continued) >The coupon rate of a floating-rate security (or floater) = reference rate + some spread or margin > The coupon rate of a floating-rate security (or floater) = some spread or margin-reference rate LIBOR + 350 For example Floater coupon: (1) Inverse floater coupon: ..........(2) 450 - LIBOR collater. RANA (2.900 2013 Pearson Education PEARSON Pricing Floating-Rate and Inverse-Floating Rate Securities EXAMPLE For example, consider a 10-year 7.5% coupon semiannual-pay bond. Suppose that $100 million of the bond is used as collateral to create a floater with a par value of $50 million and an inverse floater with a par value of $50 million. Suppose that the coupon rate is reset every six months based on the following formula: Floater coupon Inverse floater coupon: reference rate +1% 14% - reference rate Benchmark Spreads Example, on May 22, 2014, a 10-year corporate bond with a credit rating of AA were trading at 3.22%. Because the 10-year Treasury bonds on that day were trading at 2.53% (see Exhibit 5-1), (1) The relative yield spread is? (2) The yield ratio is? *3.22% 2.53% relative yield spread 0.27 = 27% 2.53% yield ratio 3.22% 2.53% 1.27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts