Question: Atlantic Airlines is considering these two alternatives for financing the purchase of a fleet of airplanes. 1. Issue 60,500 shares of common stock at $50

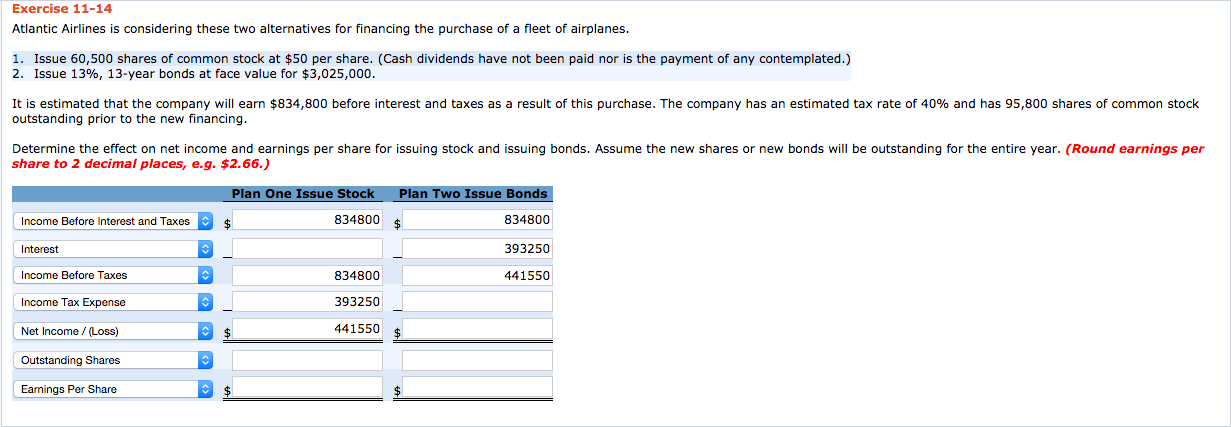

Atlantic Airlines is considering these two alternatives for financing the purchase of a fleet of airplanes.

| 1. | Issue 60,500 shares of common stock at $50 per share. (Cash dividends have not been paid nor is the payment of any contemplated.) | |

| 2. | Issue 13%, 13-year bonds at face value for $3,025,000. |

It is estimated that the company will earn $834,800 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 40% and has 95,800 shares of common stock outstanding prior to the new financing. Determine the effect on net income and earnings per share for issuing stock and issuing bonds. Assume the new shares or new bonds will be outstanding for the entire year. (Round earnings per share to 2 decimal places, e.g. $2.66.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock