Question: Atlas Corp is considering a project which involves purchasing a new piece of manufacturing equipment. The capital budgeting analysis indicates that the equipment has a

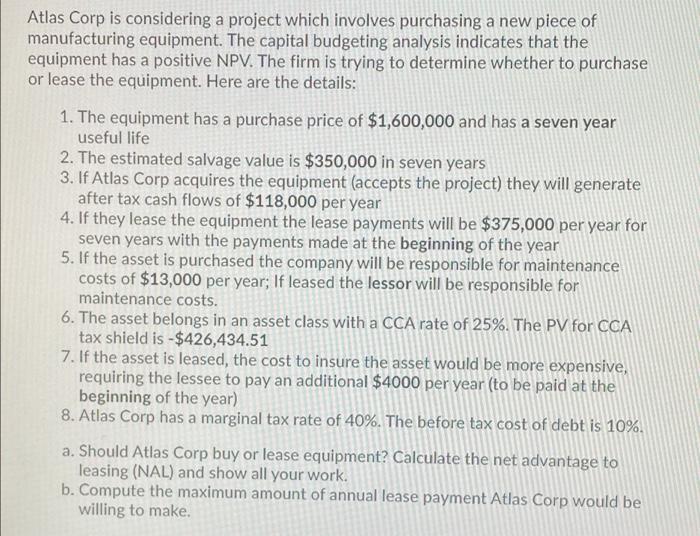

Atlas Corp is considering a project which involves purchasing a new piece of manufacturing equipment. The capital budgeting analysis indicates that the equipment has a positive NPV. The firm is trying to determine whether to purchase or lease the equipment. Here are the details: 1. The equipment has a purchase price of $1,600,000 and has a seven year useful life 2. The estimated salvage value is $350,000 in seven years 3. If Atlas Corp acquires the equipment (accepts the project) they will generate after tax cash flows of $118,000 per year 4. If they lease the equipment the lease payments will be $375,000 per year for seven years with the payments made at the beginning of the year 5. If the asset is purchased the company will be responsible for maintenance costs of $13,000 per year; If leased the lessor will be responsible for maintenance costs. 6. The asset belongs in an asset class with a CCA rate of 25%. The PV for CCA tax shield is -$426,434.51 7. If the asset is leased, the cost to insure the asset would be more expensive, requiring the lessee to pay an additional $4000 per year (to be paid at the beginning of the year) 8. Atlas Corp has a marginal tax rate of 40%. The before tax cost of debt is 10%. a. Should Atlas Corp buy or lease equipment? Calculate the net advantage to leasing (NAL) and show all your work. b. Compute the maximum amount of annual lease payment Atlas Corp would be willing to make

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts