Question: Atlas Corp. is considering two mutually exclusive projects. Both require an initial investment of $11,500 at t = 0. Project S has an expected life

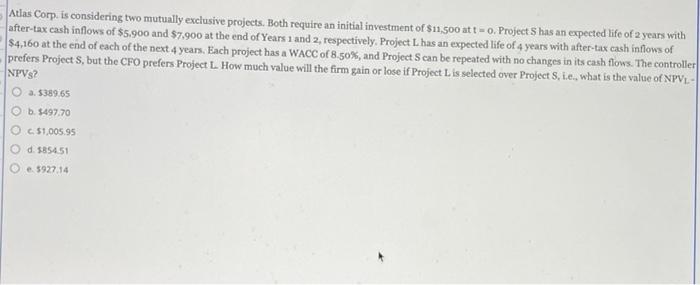

Atlas Corp. is considering two mutually exclusive projects. Both require an initial investment of $11,500 at t = 0. Project S has an expected life of 2 years with after-tax cash inflows of $5.900 and $7.900 at the end of Years 1 and 2, respectively, Project L has an expected life of 4 years with after-tax cash inflows of $4,160 at the end of each of the next 4 years. Each project has a WACC of 8.50%, and Project S can be repeated with no changes in its cash flows. The controller prefers Projects, but the CFO prefers Project L How much value will the firm gain or lose if Project Lis selected over Project S, i.e., what is the value of NPVL- NPVS2 a. 5389.65 b. 5497.70 51,005.95 d. 585451 e. 5927.14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts