Question: A.TRUE/FALSE (Each question 4 total 28 p) 1. The use of risk-adjusted discount rates is based on the concept that investors require a higher rate

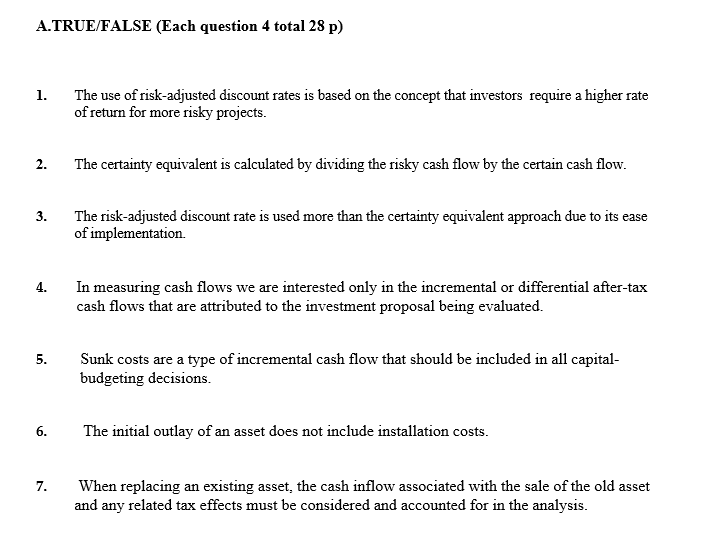

A.TRUE/FALSE (Each question 4 total 28 p) 1. The use of risk-adjusted discount rates is based on the concept that investors require a higher rate of return for more risky projects. 2. The certainty equivalent is calculated by dividing the risky cash flow by the certain cash flow. 3. The risk-adjusted discount rate is used more than the certainty equivalent approach due to its ease of implementation 4. In measuring cash flows we are interested only in the incremental or differential after-tax cash flows that are attributed to the investment proposal being evaluated. 5. Sunk costs are a type of incremental cash flow that should be included in all capital- budgeting decisions. 6. The initial outlay of an asset does not include installation costs. 7. When replacing an existing asset, the cash inflow associated with the sale of the old asset and any related tax effects must be considered and accounted for in the analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts