Question: AT&T considers rebuilding a central cell tower, which was destroyed by hurricane Sandy. The contractor showed some possible plans and the company narrowed it down

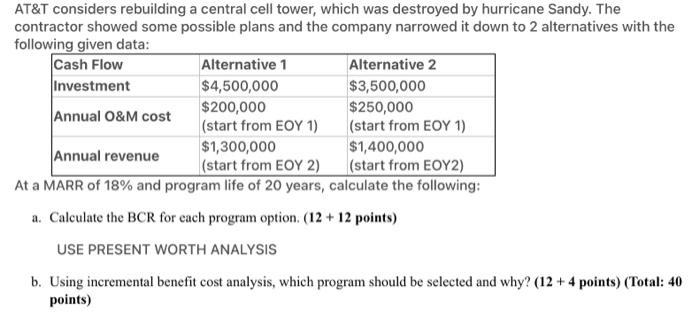

AT&T considers rebuilding a central cell tower, which was destroyed by hurricane Sandy. The contractor showed some possible plans and the company narrowed it down to 2 alternatives with the following given data: Cash Flow Alternative 1 Alternative 2 Investment $4,500,000 $3,500,000 Annual O&M cost $200,000 $250,000 (start from EOY 1) (start from EOY 1) $1,300,000 $1,400,000 Annual revenue (start from EOY 2) (start from EOY2) At a MARR of 18% and program life of 20 years, calculate the following: a. Calculate the BCR for each program option. (12 + 12 points) USE PRESENT WORTH ANALYSIS b. Using incremental benefit cost analysis, which program should be selected and why? (12 + 4 points) (Total: 40 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts