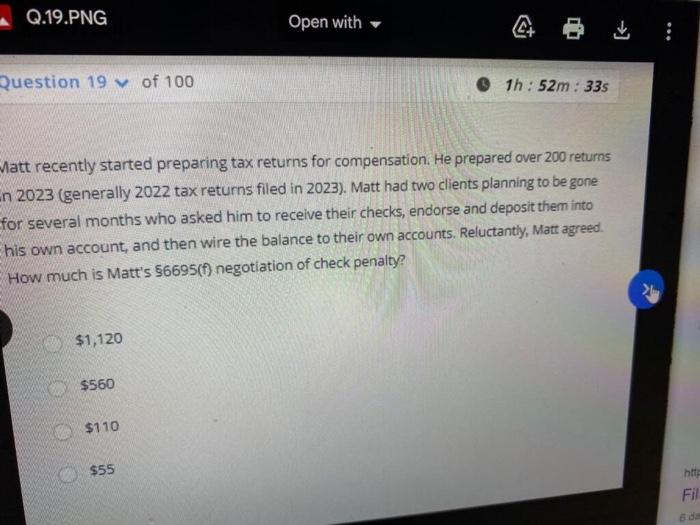

Question: att recently started preparing tax returns for compensation. He prepared over 200 returns 2023 (generally 2022 tax returns filed in 2023). Matt had two clients

att recently started preparing tax returns for compensation. He prepared over 200 returns 2023 (generally 2022 tax returns filed in 2023). Matt had two clients planning to be gone several months who asked him to receive their checks, endorse and deposit them into nis own account, and then wire the balance to their own accounts. Reluctantly, Matt agreed. How much is Matt's $6695(f) negotiation of check penalty? $1,120 $560 $110 $55

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock