Question: AT&T Wireless accepts a 6-month, $30,000, 9% note from Sprint Corporation on December 1, 2022. Assuming all necessary adjusting entries were made at year-end December

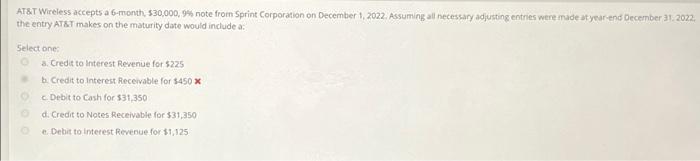

AT&T Wireless accepts a 6-month, $30,000, 9% note from Sprint Corporation on December 1, 2022. Assuming all necessary adjusting entries were made at year-end December 31, 2022, the entry AT&T makes on the maturity date would include a: Select one: a. Credit to Interest Revenue for $225 b. Credit to Interest Receivable for $450 * c. Debit to Cash for $31,350 d. Credit to Notes Receivable for $31,350 e. Debit to Interest Revenue for $1,125

ATsT Wireless accepts a 6-month, $30,000,9% note from Sprint Corporation on December 1, 2022. Assuming all necessary adjusting entries were inade atyeur-end December 31.2022. the entry ATST makes on the maturity date would include a: Select one: a. Credit to Interest Revenue for $225 b. Credit to Interest Receivable for $450X c. Debit to Cash for $31,350 d. Credit to Notes Receivable for $31,350 e. Debit to interest Revenue for $1,125

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock