Question: Attached is the question: (Please attach formula if used any) You are the senior accountant for a shoe wholesaler that uses the periodic inventory method.

Attached is the question: (Please attach formula if used any)

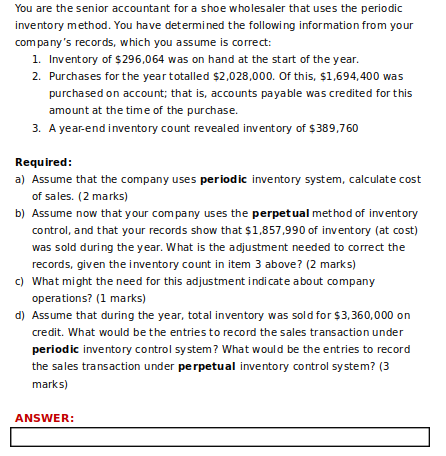

You are the senior accountant for a shoe wholesaler that uses the periodic inventory method. You have determined the following information from your company's records, which you assume is correct: 1. Inventory of $296,064 was on hand at the start of the year. 2. Purchases for the year totalled $2,028,000. Of this, $1,694, 400 was purchased on account; that is, accounts payable was credited for this amount at the time of the purchase. 3. A year-end inventory count revealed inventory of $389,760 Required: a) Assume that the company uses periodic inventory system, calculate cost of sales. (2 marks) b) Assume now that your company uses the perpetual method of inventory control, and that your records show that $1,857,990 of inventory (at cost) was sold during the year. What is the adjustment needed to correct the records, given the inventory count in item 3 above? (2 marks) () What might the need for this adjustment indicate about company operations? (1 marks) d) Assume that during the year, total inventory was sold for $3,360,000 on credit. What would be the entries to record the sales transaction under periodic inventory control system? What would be the entries to record the sales transaction under perpetual inventory control system? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts