Question: Attached is the question: Question 3 (7 marks) You are working as a finance manager for Fire Fox Transport Ltd. The company is considering to

Attached is the question:

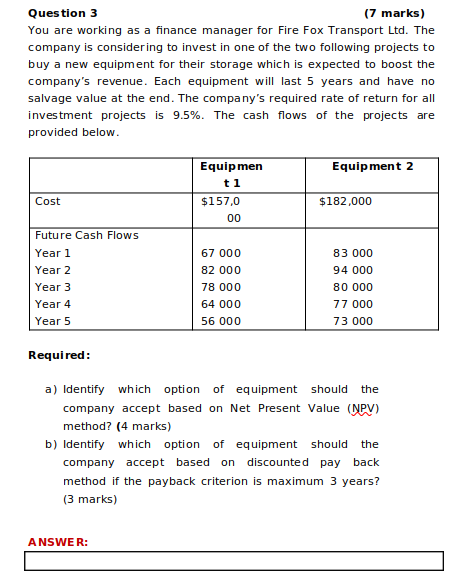

Question 3 (7 marks) You are working as a finance manager for Fire Fox Transport Ltd. The company is considering to invest in one of the two following projects to buy a new equipment for their storage which is expected to boost the company's revenue. Each equipment will last 5 years and have no salvage value at the end. The company's required rate of return for all investment projects is 9.5%. The cash flows of the projects are provided below. Equip men Equipment 2 t1 Cost $157,0 $182,000 00 Future Cash Flows Year 1 67 000 83 000 Year 2 82 000 94 000 Year 3 78 000 80 000 Year 4 64 000 77 000 Year 5 56 000 73 000 Required: a) Identify which option of equipment should the company accept based on Net Present Value (NPV) method? (4 marks) b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 3 years? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts