Question: Attached is the question: (This is everything provided, nothing is missing)(the attatched image has the formula right) Suppose that a person lives for two periods

Attached is the question: (This is everything provided, nothing is missing)(the attatched image has the formula right)

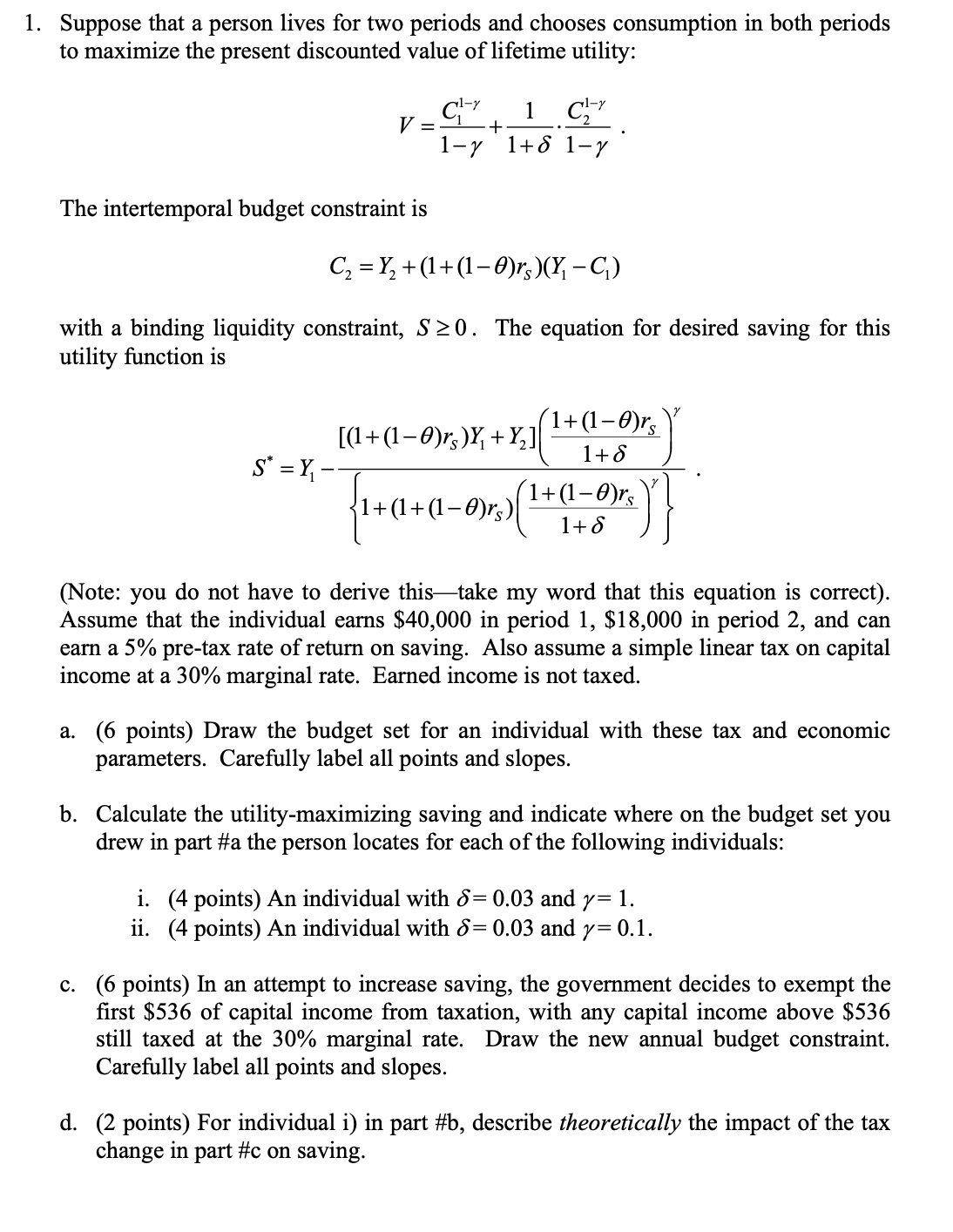

Suppose that a person lives for two periods and chooses consumption in both periods to maximize the present discounted value of lifetime utility:

C=Y+(1+(1??)r)(Y?C)22S11

with a binding liquidity constraint,S?0 . The equation for desired saving for this utility function is

1??1+?1??The intertemporal budget constraint is

C1??1C1??V=1+?2.

[(1+(1??)r)Y+Y]?1+(1??)r??S1 2?1+?S?

*??S=Y?.

1

?S?1+?S??

????1+(1+(1??)r)?1+(1??)r? ?

???? ??

(Note: you do not have to derive this?take my word that this equation is correct). Assume that the individual earns $40,000 in period 1, $18,000 in period 2, and can earn a 5% pre-tax rate of return on saving. Also assume a simple linear tax on capital income at a 30% marginal rate. Earned income is not taxed.

- (6 points) Draw the budget set for an individual with these tax and economic parameters. Carefully label all points and slopes.

- Calculate the utility-maximizing saving and indicate where on the budget set you drew in part #a the person locates for each of the following individuals:

- (4 points) An individual with?= 0.03 and?= 1.

- (4 points) An individual with?= 0.03 and?= 0.1.

- (6 points) In an attempt to increase saving, the government decides to exempt the first $536 of capital income from taxation, with any capital income above $536 still taxed at the 30% marginal rate. Draw the new annual budget constraint. Carefully label all points and slopes.

- (2 points) For individual i) in part #b, describetheoreticallythe impact of the tax change in part #c on saving.

e. (6 points) For each of the individuals in part #b, calculate how the movement to the new tax system in part #c changed theiractualsaving and indicate where on the budget constraint you drew in part #c the person now locates.

1. Suppose that a person lives for two periods and chooses consumption in both periods to maximize the present discounted value of lifetime utility: _C}"'+ 1 Cf?\" 17 1+6 17 ' V The intertemporal budget constraint is C: = Y: + (1+(1_6)rs)(Y1 _C1) with a binding liquidity constraint, S 2 0. The equation for desired saving for this utility Jnction is ahamm +Y1[%] {1+(l+(l6)rs)[l+(11+:)rq T} s'=i: (Note: you do not have to derive thistake my word that this equation is correct). Assume that the individual earns $40,000 in period 1, $18,000 in period 2, and can earn a 5% pre-tax rate of return on saving. Also assume a simple linear tax on capital income at a 30% marginal rate. Earned income is not taxed. a. (6 points) Draw the budget set for an individual with these tax and economic parameters. Carefully label all points and slopes. b. Calculate the utility-maximizing saving and indicate where on the budget set you drew in part #a the person locates for each of the following individuals: i. (4 points) An individual with = 0.03 and 7: 1. ii. (4 points) An individual with 5: 0.03 and y: 0.1. c. (6 points) In an attempt to increase saving, the government decides to exempt the rst $536 of capital income from taxation, with any capital income above $536 still taxed at the 30% marginal rate. Draw the new annual budget constraint. Careilly label all points and slopes. d. (2 points) For individual i) in part #b, describe theoretically the impact of the tax change in part #c on saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts