Question: Attempt all problems If you need to make an assumption to complete a calculation be explicit about what it is Q1) (10 Points) A stock

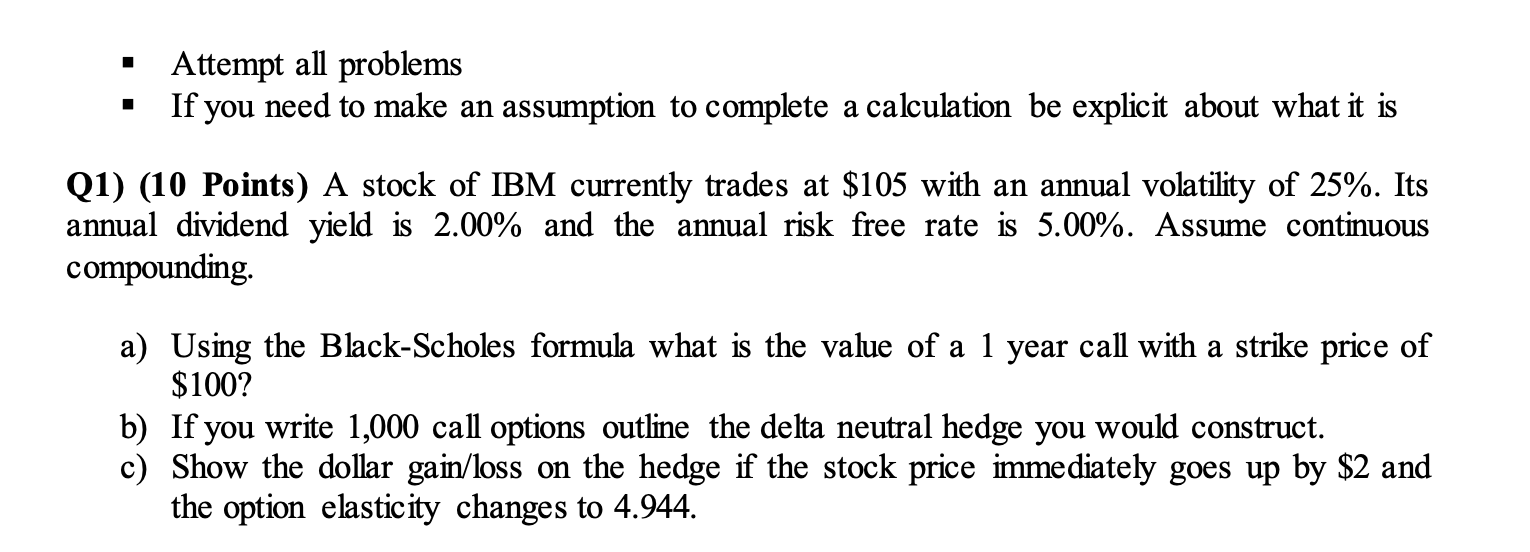

Attempt all problems If you need to make an assumption to complete a calculation be explicit about what it is Q1) (10 Points) A stock of IBM currently trades at $105 with an annual volatility of 25%. Its annual dividend yield is 2.00% and the annual risk free rate is 5.00%. Assume continuous compounding a) Using the Black-Scholes formula what is the value of a 1 year call with a strike price of $100? b) If you write 1,000 call options outline the delta neutral hedge you would construct. c) Show the dollar gain/loss on the hedge if the stock price immediately goes up by $2 and the option elasticity changes to 4.944. Attempt all problems If you need to make an assumption to complete a calculation be explicit about what it is Q1) (10 Points) A stock of IBM currently trades at $105 with an annual volatility of 25%. Its annual dividend yield is 2.00% and the annual risk free rate is 5.00%. Assume continuous compounding a) Using the Black-Scholes formula what is the value of a 1 year call with a strike price of $100? b) If you write 1,000 call options outline the delta neutral hedge you would construct. c) Show the dollar gain/loss on the hedge if the stock price immediately goes up by $2 and the option elasticity changes to 4.944

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts