Question: ATTEMPT ALL THREE (3) QUESTIONS QUESTION ONE RST Ple is a stock exchange listed manufacturing company. Following a decision made by the board to expand

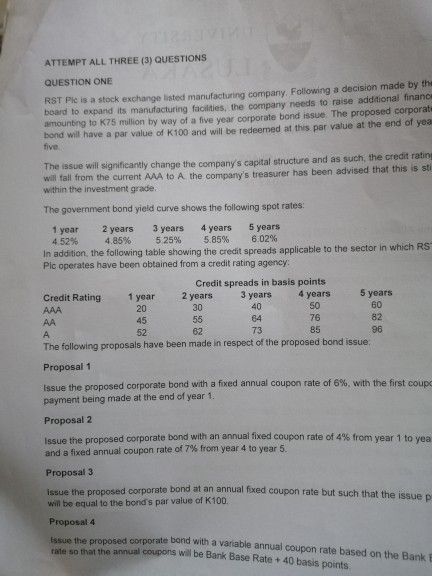

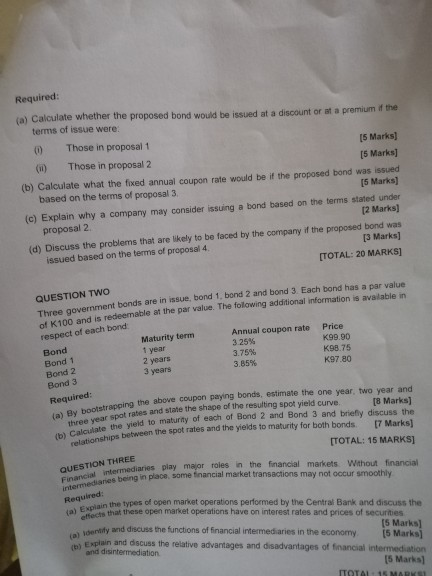

ATTEMPT ALL THREE (3) QUESTIONS QUESTION ONE RST Ple is a stock exchange listed manufacturing company. Following a decision made by the board to expand its manufacturing facilities, the company needs to raise additional finance amounting to K75 million by way of a five year corporate bond issue. The proposed corporat bond will have a par value of K100 and will be redeemed at this par value at the end of yea five The issue will significantly change the company's capital structure and as such, the credit ratin will fall from the current AAA to A the company's treasurer has been advised that this is sti within the investment grade. The government bond yield curve shows the following spot rates: 1 year 2 years 3 years 4 years 5 years 4.52% 4.85% 5.25% 5.85% 6.02% In addition, the following table showing the credit spreads applicable to the sector in which RS Plc operates have been obtained from a credit rating agency Credit spreads in basis points Credit Rating 1 year 2 years 3 years 4 years 5 years AAA 20 50 64 76 73 96 The following proposals have been made in respect of the proposed bond issue. 60 82 AA Proposal 1 Issue the proposed corporate bond with a fixed annual coupon rate of 6%, with the first coups payment being made at the end of year 1. Proposal 2 Issue the proposed corporate bond with an annual fixed coupon rate of 4% from year 1 to wea and a fixed annual coupon rate of 7% from year 4 to year 5. Proposal 3 the proposed corporate bond at an annual fixed coupon rate but such that the issue will be equal to the bond's par value of K100 Proposal 4 Issue the proposed corporate bond with a variable annual coupon rate based on the Bank that the annual coupons will be Bark Base Rate + 40 basis points Required: (a) Calculate whether the proposed bond would be issued at a discount or at a premium if the terms of issue were: 0 Those in proposal 1 [5 Marks) (1) Those in proposal 2 [5 Marks] (b) Calculate what the fixed annual coupon rate would be if the proposed bond was issued based on the terms of proposal 3 [5 Marks) (C) Explain why a company may consider issuing a bond based on the terms stated under [2 Marks] proposal 2 (d) Discuss the problems that are likely to be faced by the company if the proposed bond was [3 Marks] issued based on the terms of proposal 4 [TOTAL: 20 MARKS] QUESTION TWO Three government bonds are in issue, bond 1, bond 2 and bond 3 Each bond has a par value K100 and is redeemable at the par value. The following additional information is available in respect of each bond Maturity term Annual coupon rate Price Bond 1 year 3 25% K99 90 2 years 3.75% K98.75 3 years K97.80 Bond 3 3.85% Bond 1 Bond 2 Required: (a) y bootstrapping the above three year spat rates and an in the above coupon paying bonds, estimate the one year two year and rates and state the shape of the resulting spot yield curve. (8 Marks] the yield to maturity of each of Bond 2 and Bond 3 and briefly discuss the b etween the spot rates and the yields to maturity for both bonds 7 Marks] [TOTAL: 15 MARKS] (b) Calcu QUESTION THREE Financial termediaries play major roles in the financial markets Without financial being in place some financial market transactions may not occur smoothly intermedianes being in Required: a) E in the types of open market operations performed by the Central Bank and discuss the that these open market operations have on interest rates and prices of securities (5 Marks) dentity and discuss the functions of financial intermediaries in the economy 15 Marksi Explain and discuss the relative advantages and disadvantages of financial intermediation and disintermediation (5 Marks] TOTAL 15 MARS ATTEMPT ALL THREE (3) QUESTIONS QUESTION ONE RST Ple is a stock exchange listed manufacturing company. Following a decision made by the board to expand its manufacturing facilities, the company needs to raise additional finance amounting to K75 million by way of a five year corporate bond issue. The proposed corporat bond will have a par value of K100 and will be redeemed at this par value at the end of yea five The issue will significantly change the company's capital structure and as such, the credit ratin will fall from the current AAA to A the company's treasurer has been advised that this is sti within the investment grade. The government bond yield curve shows the following spot rates: 1 year 2 years 3 years 4 years 5 years 4.52% 4.85% 5.25% 5.85% 6.02% In addition, the following table showing the credit spreads applicable to the sector in which RS Plc operates have been obtained from a credit rating agency Credit spreads in basis points Credit Rating 1 year 2 years 3 years 4 years 5 years AAA 20 50 64 76 73 96 The following proposals have been made in respect of the proposed bond issue. 60 82 AA Proposal 1 Issue the proposed corporate bond with a fixed annual coupon rate of 6%, with the first coups payment being made at the end of year 1. Proposal 2 Issue the proposed corporate bond with an annual fixed coupon rate of 4% from year 1 to wea and a fixed annual coupon rate of 7% from year 4 to year 5. Proposal 3 the proposed corporate bond at an annual fixed coupon rate but such that the issue will be equal to the bond's par value of K100 Proposal 4 Issue the proposed corporate bond with a variable annual coupon rate based on the Bank that the annual coupons will be Bark Base Rate + 40 basis points Required: (a) Calculate whether the proposed bond would be issued at a discount or at a premium if the terms of issue were: 0 Those in proposal 1 [5 Marks) (1) Those in proposal 2 [5 Marks] (b) Calculate what the fixed annual coupon rate would be if the proposed bond was issued based on the terms of proposal 3 [5 Marks) (C) Explain why a company may consider issuing a bond based on the terms stated under [2 Marks] proposal 2 (d) Discuss the problems that are likely to be faced by the company if the proposed bond was [3 Marks] issued based on the terms of proposal 4 [TOTAL: 20 MARKS] QUESTION TWO Three government bonds are in issue, bond 1, bond 2 and bond 3 Each bond has a par value K100 and is redeemable at the par value. The following additional information is available in respect of each bond Maturity term Annual coupon rate Price Bond 1 year 3 25% K99 90 2 years 3.75% K98.75 3 years K97.80 Bond 3 3.85% Bond 1 Bond 2 Required: (a) y bootstrapping the above three year spat rates and an in the above coupon paying bonds, estimate the one year two year and rates and state the shape of the resulting spot yield curve. (8 Marks] the yield to maturity of each of Bond 2 and Bond 3 and briefly discuss the b etween the spot rates and the yields to maturity for both bonds 7 Marks] [TOTAL: 15 MARKS] (b) Calcu QUESTION THREE Financial termediaries play major roles in the financial markets Without financial being in place some financial market transactions may not occur smoothly intermedianes being in Required: a) E in the types of open market operations performed by the Central Bank and discuss the that these open market operations have on interest rates and prices of securities (5 Marks) dentity and discuss the functions of financial intermediaries in the economy 15 Marksi Explain and discuss the relative advantages and disadvantages of financial intermediation and disintermediation (5 Marks] TOTAL 15 MARS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts