Question: ATTEMPT ANY TWO QUESTIONS ( MAF 9 4 1 ADVANCED TAXUTION ) QUESTION ONE The DOOK PROFIT is the accourting proft found in the income

ATTEMPT ANY TWO QUESTIONS MAF ADVANCED TAXUTION

QUESTION ONE

The "DOOK PROFIT" is the accourting proft found in the income statemert as asthorkes in the arrual tax return. For the two prefts, that is "DOCK PROFIT" and TAX PRCHit' fours; Gve at least two reasons why the two proff figures thould be the same in pricciple. Give at least two reasons why the two proft figures would not be expected to be the same.

Total: marks

QUESTION TWO

The effective tax rate ETR is one important performance measure for the tas department. ETR is also used to measure tax avoidance betavisur, whether aggressive or otherwise.

Required:

Eplain the une of ETR as an appropriate performance measurement tool for the tar department as well as k ETR being used as a tool for measuring tax avidanct behaviour

QUESTION THREE

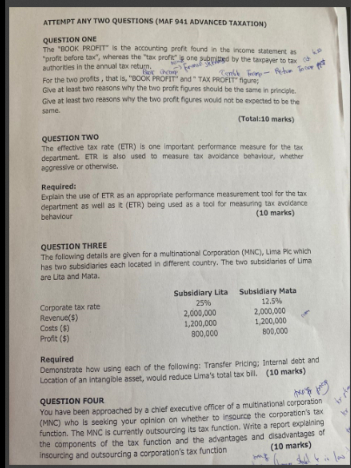

The foliowing details are given for a multinational Corporation MNC Lima Fic which has two subsidiaries each located in offerent country. The two subsidiaries of Lime are Lita and Mata.

Required

Demonstrate how using each of the following: Transfer Pticing; Internal debt and Location of an intangible asset, would reduce Uma's total tax bili. marks

QUESTION FOUR

You have been approached by a chicf executive officer of a multinational corporation MNC who is sobking your opinion on whether to irsource the corporation's tax function. The MNC is currently outsourcing its tax function. Write a report eplaining the components of the tax function and the advantages and disadvantages of inscurcing and outsourcing a corporation's tax function

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock