Question: Attempts 1 Keep the Highest 1 / 2 4 . Exercise 1 7 . 4 Alliance Manufacturing Company is considering the purchase of a new

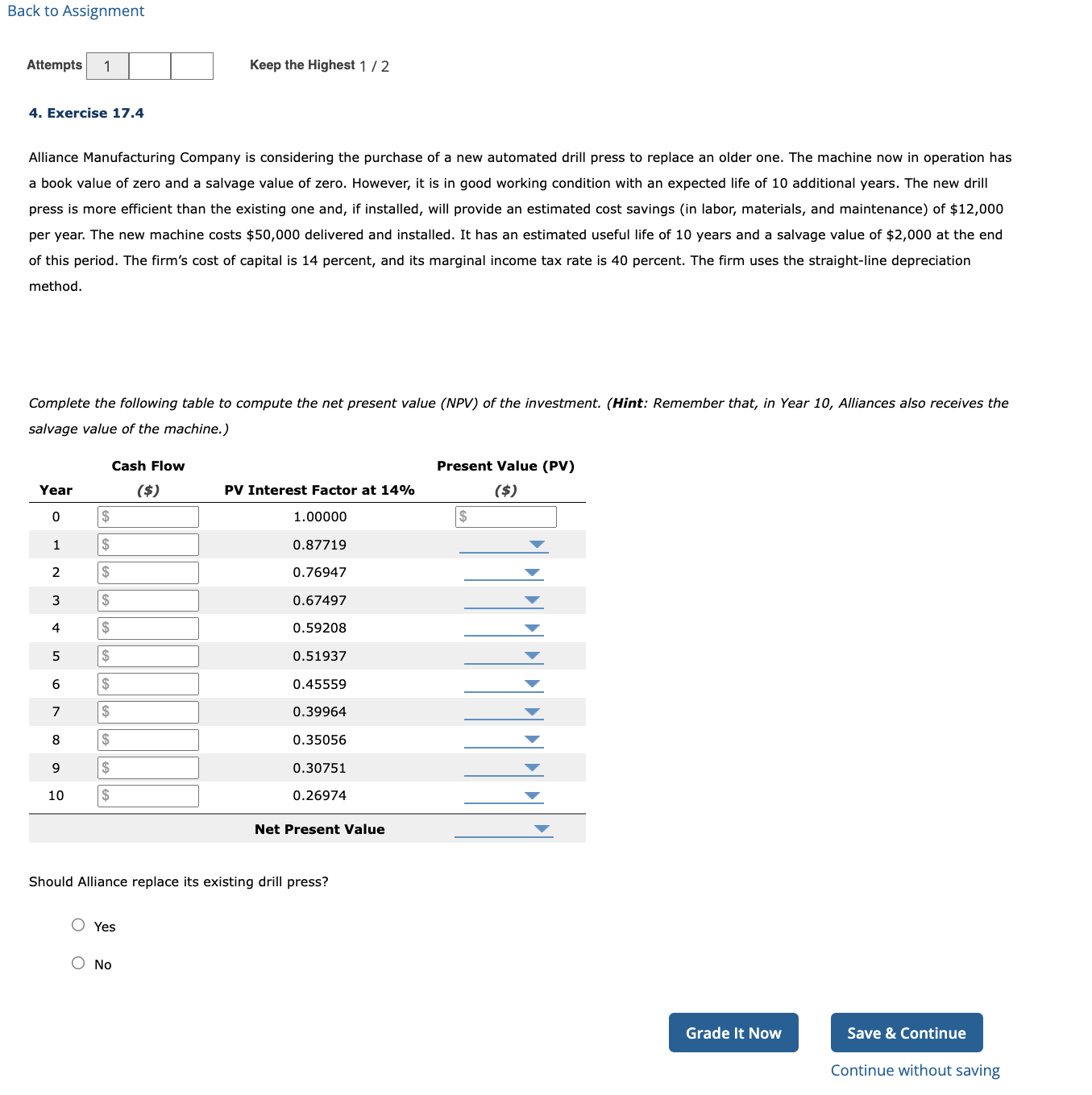

Attempts Keep the Highest Exercise Alliance Manufacturing Company is considering the purchase of a new automated drill press to replace an older one. The machine now in operation has a book value of zero and a salvage value of zero. However, it is in good working condition with an expected life of additional years. The new drill press is more efficient than the existing one and, if installed, will provide an estimated cost savings in labor, materials, and maintenance of $ per year. The new machine costs $ delivered and installed. It has an estimated useful life of years and a salvage value of $ at the end of this period. The firm's cost of capital is percent, and its marginal income tax rate is percent. The firm uses the straightline depreciation method. Complete the following table to compute the net present value NPV of the investment. Hint: Remember that, in Year Alliances also receives the salvage value of the machine. Cash Flow Present Value PV Should Alliance replace its existing drill press? Yes No

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock