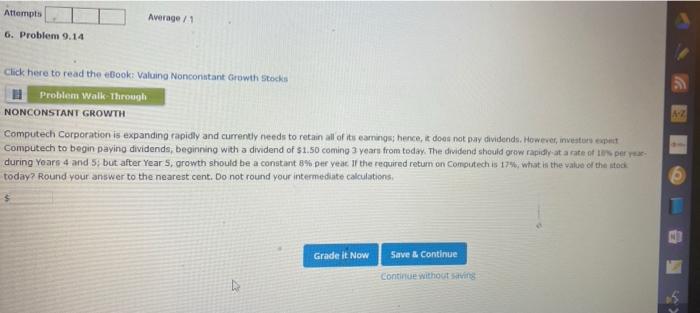

Question: Attempts Average 1 6. Problem 9.14 Click here to read the eBook: Valuing Nonconstant Growth Stocks Problem Walk Through NONCONSTANT GROWTH Computech Corporation is expanding

Attempts Average 1 6. Problem 9.14 Click here to read the eBook: Valuing Nonconstant Growth Stocks Problem Walk Through NONCONSTANT GROWTH Computech Corporation is expanding rapidly and currently needs to retain all of its earnings hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.50 coming 3 years from today. The dividend should grow rapidly at a rate of sper year during Years 4 and 5: but after Year 5 growth should be a constant 8% per year if the required return on Computech is 17%, what in the value of the stock today? Round your answer to the nearest cent. Do not round your intermediate calculations Grade it Now Save & Continue Continue withouting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts