Question: Attempts Average: 6 Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more 4. The beta

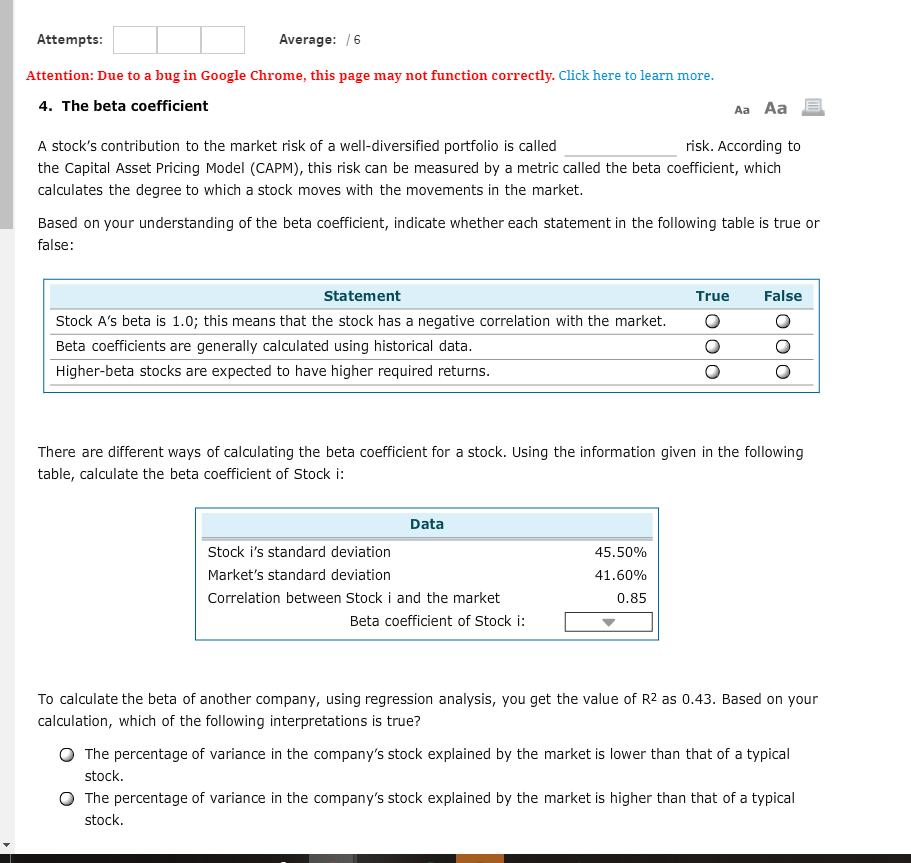

Attempts Average: 6 Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more 4. The beta coefficient Aa Aa A stock's contribution to the market risk of a well-diversified portfolio is called the Capital Asset Pricing Model (CAPM), this risk can be measured by a metric called the beta coefficient, which calculates the degree to which a stock moves with the movements in the market risk. According to Based on your understanding of the beta coefficient, indicate whether each statement in the following table is true or false Statement True False Stock A's beta is 1.0; this means that the stock has a negative correlation with the market.O Beta coefficients are generally calculated using historical data Higher-beta stocks are expected to have higher required returns There are different ways of calculating the beta coefficient for a stock. Using the information given in the following table, calculate the beta coefficient of Stock i: Data Stock i's standard deviation Market's standard deviation Correlation between Stock i and the market 45.50% 41.60% 0.85 Beta coefficient of Stock i To calculate the beta of another company, using regression analysis, you get the value of R2 as 0.43. Based on your calculation, which of the following interpretations is true? O The percentage of variance in the company's stock explained by the market is lower than that of a typical stock. O The percentage of variance in the company's stock explained by the market is higher than that of a typical stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts