Question: Attempts:* Average: /7 1. Apply What You ve Learned -Managing Your Employer's RetirementPlan Scenario: You are 27-years-old and working in the marketing department of a

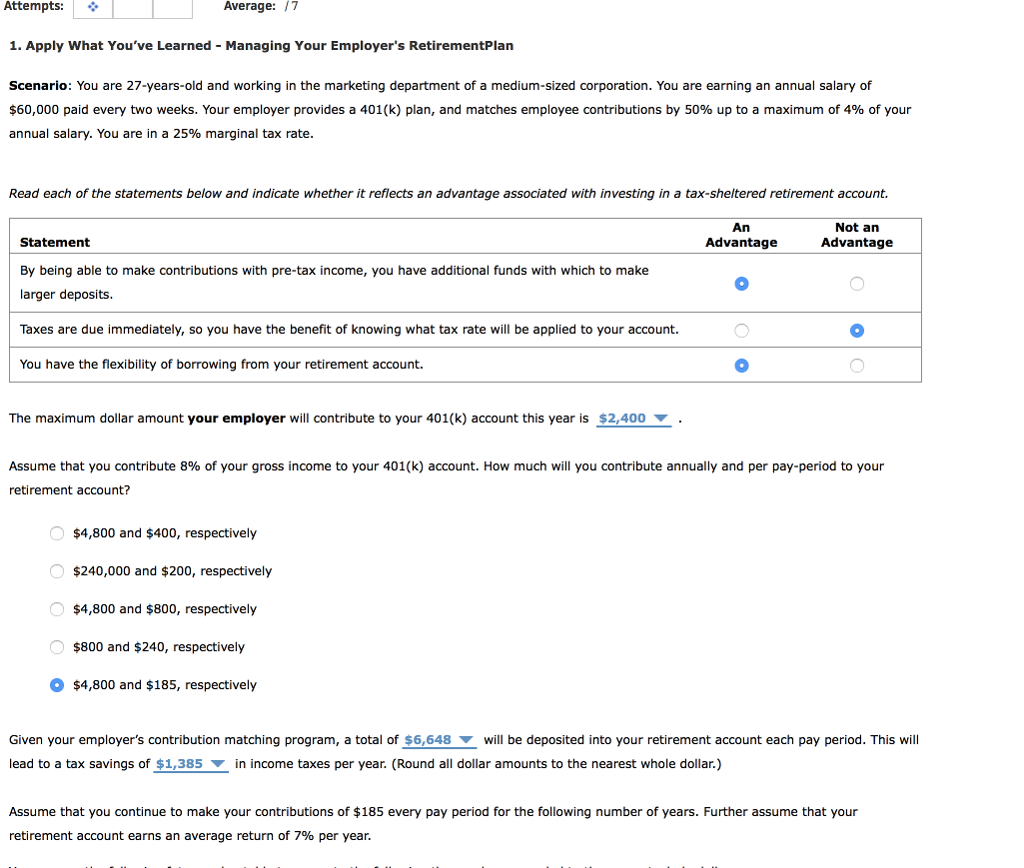

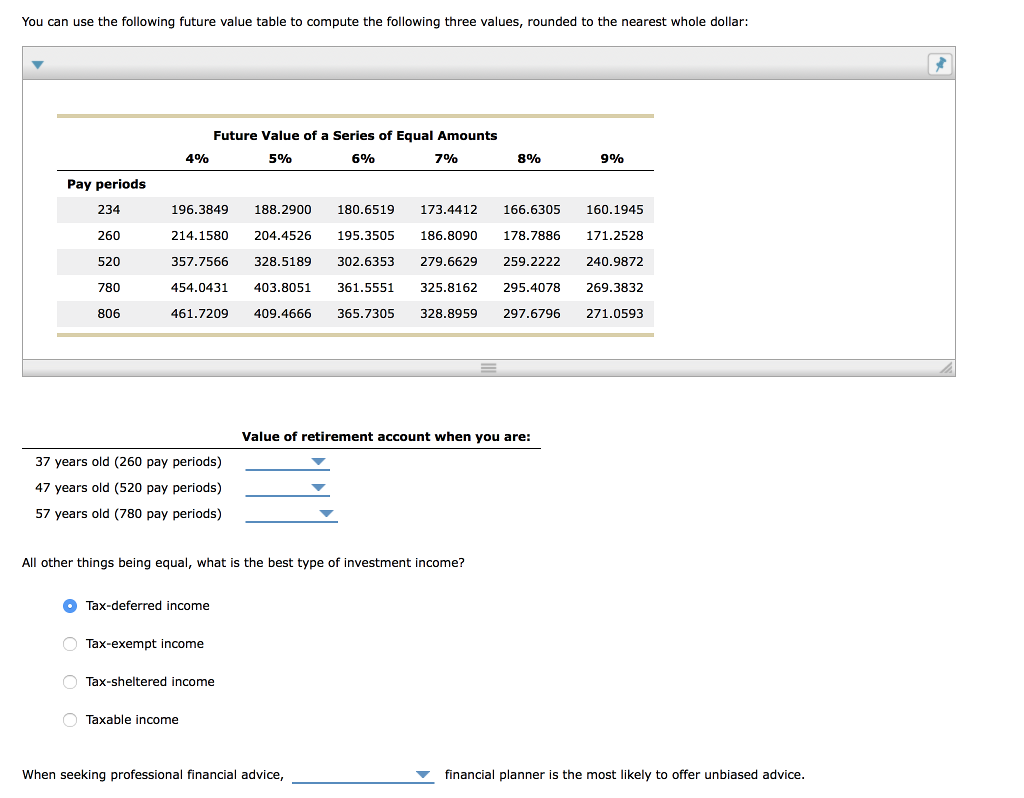

Attempts:* Average: /7 1. Apply What You ve Learned -Managing Your Employer's RetirementPlan Scenario: You are 27-years-old and working in the marketing department of a medium-sized corporation. You are earning an annual salary of $60,000 paid every two weeks. Your employer provides a 401(k) plan, and matches employee contributions by 50% up to a maximum of 4% of your annual salary. You are in a 25% marginal tax rate Read each of the statements below and indicate whether it reflects an advantage associated with investing in a tax-sheltered retirement account. An Advantage Not an Advantage Statement By being able to make contributions with pre-tax income, you have additional funds with which to make larger deposits Taxes are due immediately, so you have the benefit of knowing what tax rate will be applied to your account You have the flexibility of borrowing from your retirement account. The maximum dollar amount your employer will contribute to your 401(k) account this year is $2,400 . Assume that you contribute 8% of your gross income to your 401(k) account. How much will you contribute annually and per pay-period to your retirement account? $4,800 and $400, respectively $240,000 and $200, respectively $4,800 and $800, respectively $800 and $240, respectively $4,800 and $185, respectively Given your employer's contribution matching program, a total of S6648 will be deposited into your retirement account each pay period. This will lead to a tax savings of $1,385 in income taxes per year. (Round all dollar amounts to the nearest whole dollar.) Assume that you continue to make your contributions of $185 every pay period for the following number of years. Further assume that your retirement account earns an average return of 7% per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts