Question: Attempts: Average: 73 3. Dividend policy A Aa 3 A firm's value depends on its expected free cash flow and its cost of capital. Distributions

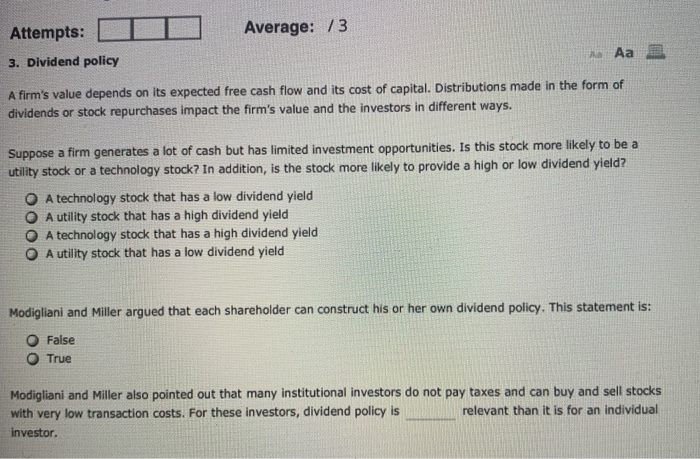

Attempts: Average: 73 3. Dividend policy A Aa 3 A firm's value depends on its expected free cash flow and its cost of capital. Distributions made in the form of dividends or stock repurchases impact the firm's value and the investors in different ways. Suppose a firm generates a lot of cash but has limited investment opportunities. Is this stock more likely to be a utility stock or a technology stock? In addition, is the stock more likely to provide a high or low dividend yield? A technology stock that has a low dividend yield O A utility stock that has a high dividend yield A technology stock that has a high dividend yield O A utility stock that has a low dividend yield Modigliani and Miller argued that each shareholder can construct his or her own dividend policy. This statement is: False True Modigliani and Miller also pointed out that many institutional investors do not pay taxes and can buy and sell stocks with very low transaction costs. For these investors, dividend policy is relevant than it is for an individual investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts