Question: Attempts: Average: 74 3. Understanding business and financial risks Aa Aa E The total risk in a firm is determined by evaluating the firm's business

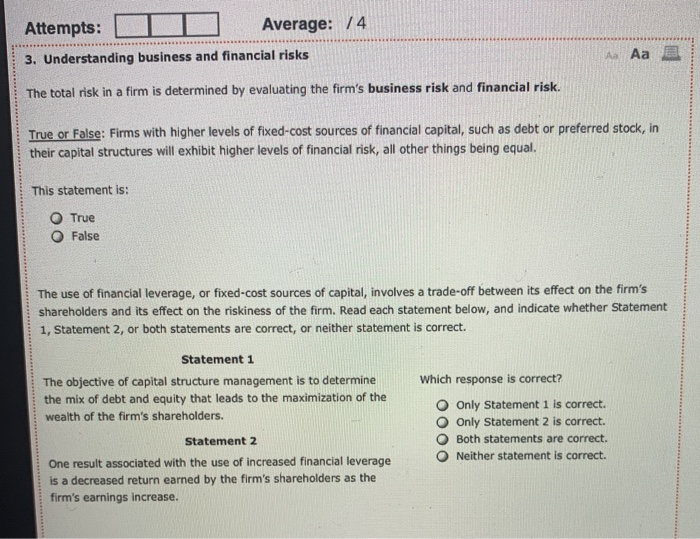

Attempts: Average: 74 3. Understanding business and financial risks Aa Aa E The total risk in a firm is determined by evaluating the firm's business risk and financial risk. True or False: Firms with higher levels of fixed-cost sources of financial capital, such as debt or preferred stock, in their capital structures will exhibit higher levels of financial risk, all other things being equal. This statement is: True False The use of financial leverage, or fixed-cost sources of capital, involves a trade-off between its effect on the firm's shareholders and its effect on the riskiness of the firm. Read each statement below, and indicate whether Statement 1, Statement 2, or both statements are correct, or neither statement is correct. Statement 1 The objective of capital structure management is to determine the mix of debt and equity that leads to the maximization of the wealth of the firm's shareholders. Which response is correct? Only Statement 1 is correct. Only Statement 2 is correct. Both statements are correct. Neither statement is correct. Statement 2 One result associated with the use of increased financial leverage is a decreased return earned by the firm's shareholders as the firm's earnings increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts