Question: Attempts Do No Harm/2 6. Adjusting for beta risk in capital budgeting - Debt and equity case The risk-adjusted discount rate approach is widely used

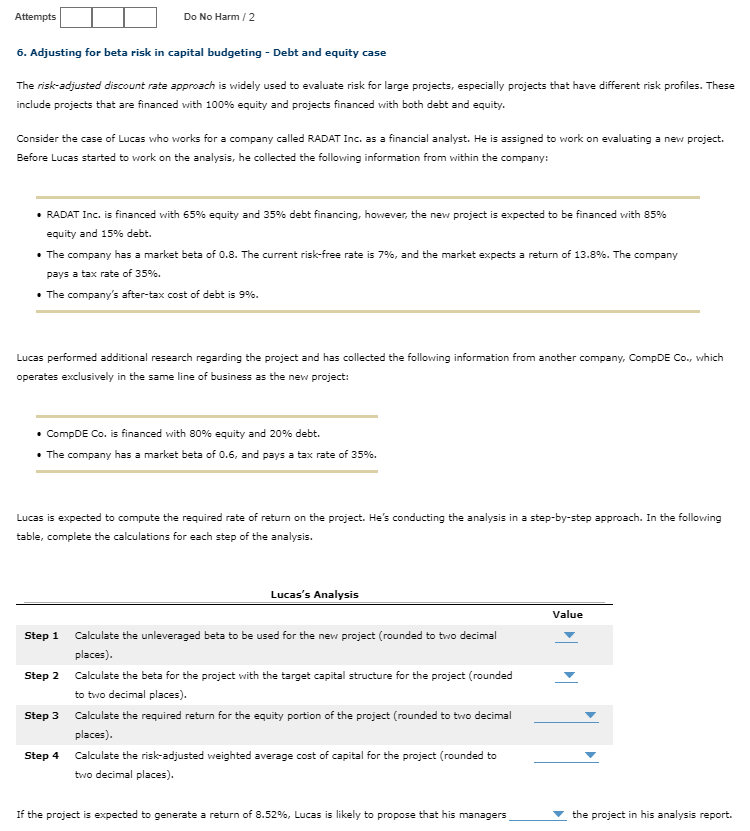

Attempts Do No Harm/2 6. Adjusting for beta risk in capital budgeting - Debt and equity case The risk-adjusted discount rate approach is widely used to evaluate risk for large projects, especially projects that have different risk profiles. These include projects that are financed with 100% equity and projects financed with both debt and equity. Consider the case of Lucas who works for a company called RADAT Inc. as a financial analyst. He is assigned to work on evaluating a new project. Before Lucas started to work on the analysis, he collected the following information from within the company: RADAT Inc. is financed with 55% equity and 35% debt financing, however, the new project is expected to be financed with 85% equity and 15% debt. The company has a market beta of 0.8. The current risk-free rate is 7%, and the market expects a return of 13.8%. The company pays a tax rate of 35%. The company's after-tax cost of debt is 9%. a Lucas performed additional research regarding the project and has collected the following information from another company, CompDE Co., which operates exclusively in the same line of business as the new project: CompDE Co. is financed with 80% equity and 20% debt. The company has a market beta of 0.6, and pays a tax rate of 35%. Lucas is expected to compute the required rate of return on the project. He's conducting the analysis in a step-by-step approach. In the following table, complete the calculations for each step of the analysis. Lucas's Analysis Value Step 1 Calculate the unleveraged beta to be used for the new project (rounded to two decimal places). Step 2 Calculate the beta for the project with the target capital structure for the project (rounded to two decimal places). Step 3 Calculate the required return for the equity portion of the project (rounded to two decimal places). Step 4 Calculate the risk-adjusted weighted average cost of capital for the project (rounded to two decimal places). If the project is expected to generate a return of 8.52%, Lucas is likely to propose that his managers the project in his analysis report Attempts Do No Harm/2 6. Adjusting for beta risk in capital budgeting - Debt and equity case The risk-adjusted discount rate approach is widely used to evaluate risk for large projects, especially projects that have different risk profiles. These include projects that are financed with 100% equity and projects financed with both debt and equity. Consider the case of Lucas who works for a company called RADAT Inc. as a financial analyst. He is assigned to work on evaluating a new project. Before Lucas started to work on the analysis, he collected the following information from within the company: RADAT Inc. is financed with 55% equity and 35% debt financing, however, the new project is expected to be financed with 85% equity and 15% debt. The company has a market beta of 0.8. The current risk-free rate is 7%, and the market expects a return of 13.8%. The company pays a tax rate of 35%. The company's after-tax cost of debt is 9%. a Lucas performed additional research regarding the project and has collected the following information from another company, CompDE Co., which operates exclusively in the same line of business as the new project: CompDE Co. is financed with 80% equity and 20% debt. The company has a market beta of 0.6, and pays a tax rate of 35%. Lucas is expected to compute the required rate of return on the project. He's conducting the analysis in a step-by-step approach. In the following table, complete the calculations for each step of the analysis. Lucas's Analysis Value Step 1 Calculate the unleveraged beta to be used for the new project (rounded to two decimal places). Step 2 Calculate the beta for the project with the target capital structure for the project (rounded to two decimal places). Step 3 Calculate the required return for the equity portion of the project (rounded to two decimal places). Step 4 Calculate the risk-adjusted weighted average cost of capital for the project (rounded to two decimal places). If the project is expected to generate a return of 8.52%, Lucas is likely to propose that his managers the project in his analysis report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts