Question: Attempts Force Once started, this test must be completed in one sitting. Do not leave the test before clicking Save and Submit Completion Remaining Time:

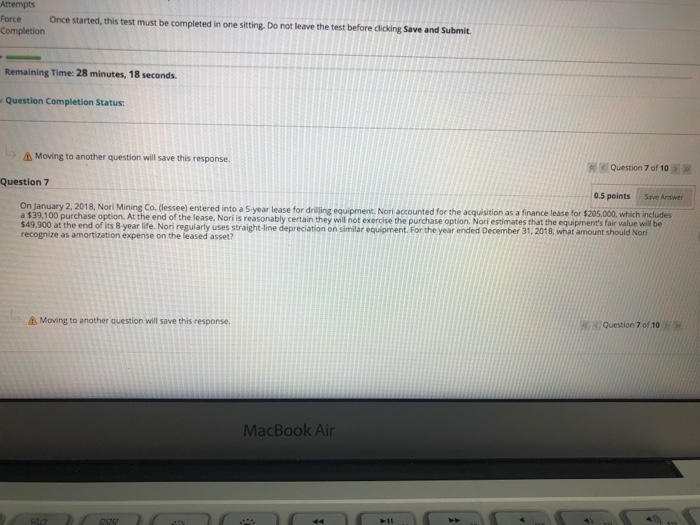

Attempts Force Once started, this test must be completed in one sitting. Do not leave the test before clicking Save and Submit Completion Remaining Time: 28 minutes, 18 seconds. Question Completion Status: Moving to another question will save this response. Question 7 of 10 Question 7 0.5 points Sve Answer On January 2, 2018, Nori Mining Co. (lessee) entered into a 5-year lease for drilling equipment. Nori accounted for the acquisition as a finance lease for $205,000, which includes a $19,100 purchase option. At the end of the lease, Nori is reasonably certain they will not exercise the purchase option. Nori estimates that the equipment's fair value will be $49,900 at the end of its 8-year life. Nori regularly uses straight-line depreciation on similar equipment. For the year ended December 31, 2018, what amount should Nori recognize as amortization expense on the leased asset? Moving to another question will save this response. Question 7 of 10 MacBook Air POP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts