Question: Attempts Keep the Highest / 1 5. 5: The Cost of Capital: Cost of New Common Stock If a firm plans to Issue new stock,

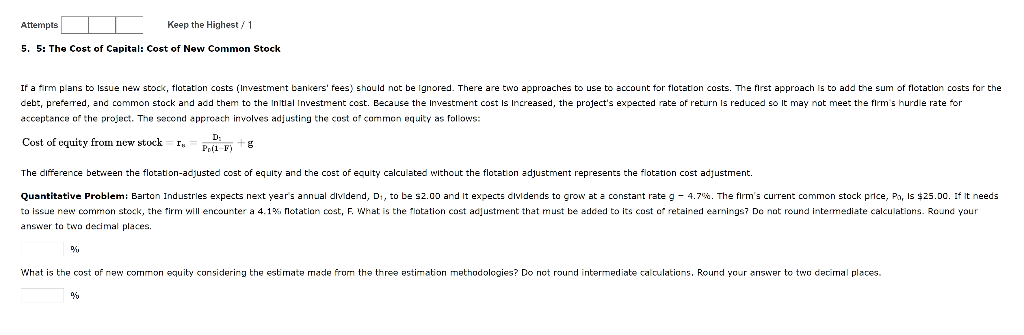

Attempts Keep the Highest / 1 5. 5: The Cost of Capital: Cost of New Common Stock If a firm plans to Issue new stock, flotation costs (Investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial Investment cost. Because the Investment cost Is Increased, the project's expected rate of return is reduced so It may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows: Cost of cquity from the stock r Poll Fig The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be s2.00 and It expects dividends grow at a constant rate g - 4.7%. The firm's current common stock price, Pa, Is $25.00. If It needs to issue new common stock, the firm will encounter a 4.12 Notation cost, F. What is the flotation cost adjustment that must be added to its cost of retained earnings7 De nat round intermediate calculations. Round your answer to two decimal places. DU What is the cost of new common equity considering the estimate made from the three estimation methodologies? Do nct round intermediate calculations. Round your answer to two decimal places. 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts