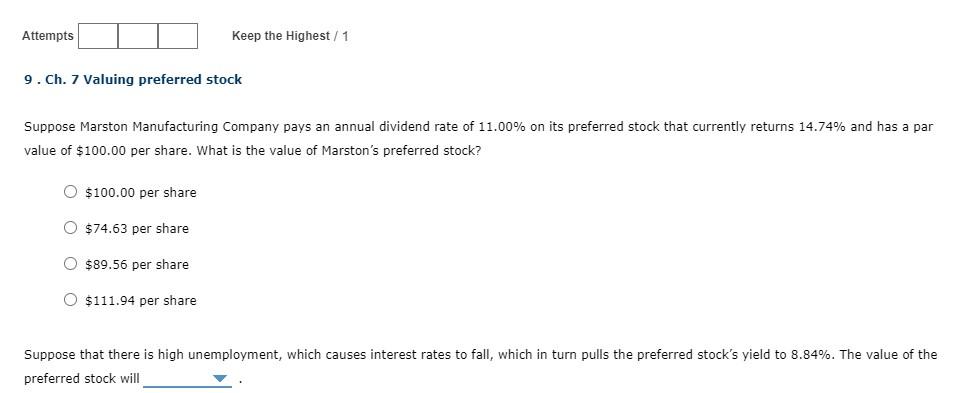

Question: Attempts Keep the Highest / 1 9. Ch. 7 Valuing preferred stock Suppose Marston Manufacturing Company pays an annual dividend rate of 11.00% on its

Attempts Keep the Highest / 1 9. Ch. 7 Valuing preferred stock Suppose Marston Manufacturing Company pays an annual dividend rate of 11.00% on its preferred stock that currently returns 14.74% and has a par value of $100.00 per share. What is the value of Marston's preferred stock? $100.00 per share O $74.63 per share O $89.56 per share O $111.94 per share Suppose that there is high unemployment, which causes interest rates to fall, which in turn pulls the preferred stock's yield to 8.84%. The value of the preferred stock will

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts