Question: Attempts Keep the Highest / 12 11. Problem 10-08 (NPVS, IRRs, and MIRRS for Independent Projects) eBook NPVS, IRRS, and MIRRS for Independent Projects Edelman

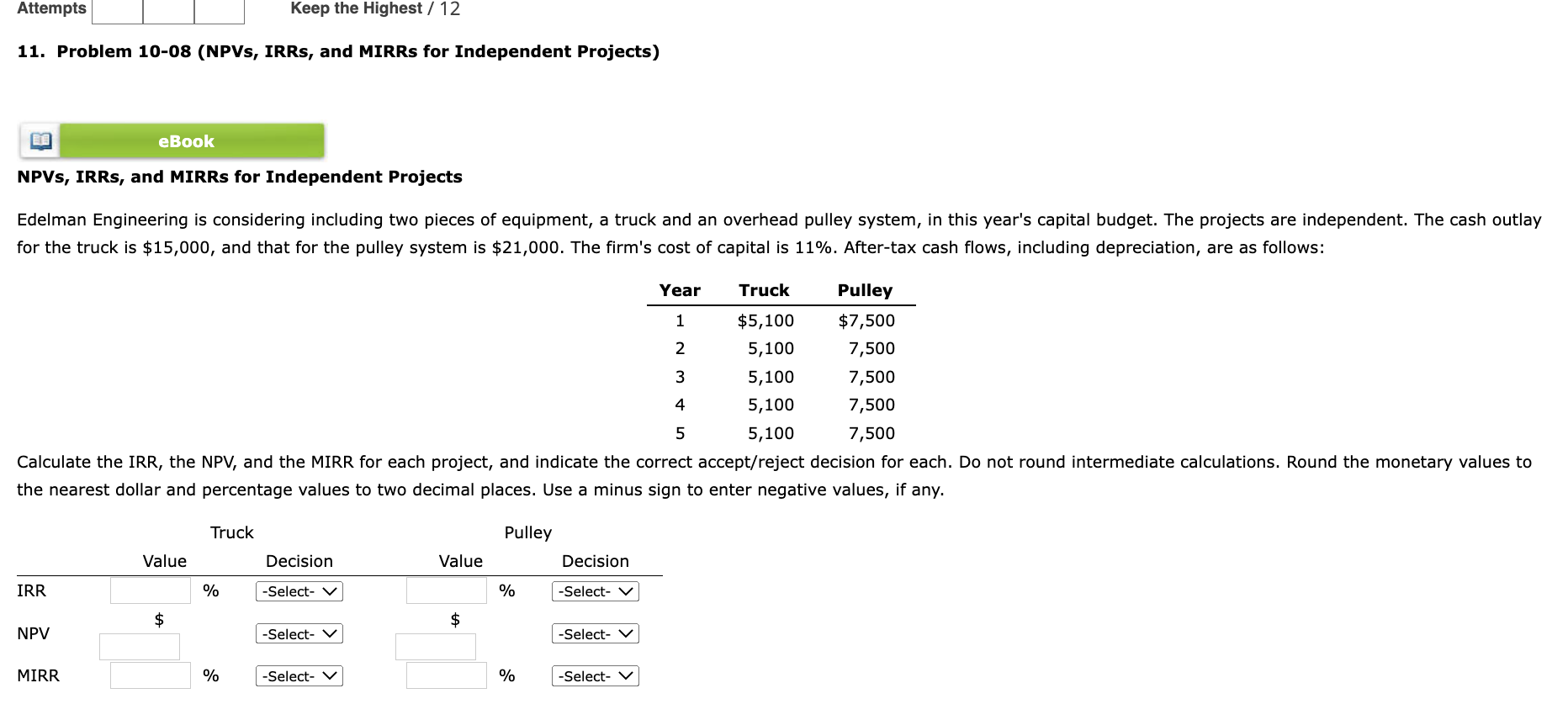

Attempts Keep the Highest / 12 11. Problem 10-08 (NPVS, IRRs, and MIRRS for Independent Projects) eBook NPVS, IRRS, and MIRRS for Independent Projects Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year's capital budget. The projects are independent. The cash outlay for the truck is $15,000, and that for the pulley system is $21,000. The firm's cost of capital is 11%. After-tax cash flows, including depreciation, are as follows: IRR NPV Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal places. Use a minus sign to enter negative values, if any. Pulley MIRR Value $ Truck % % Decision -Select- V -Select- V -Select- V Value $ % % Decision -Select- V -Select- V Year 1 2 3 4 5 -Select- V Truck $5,100 5,100 5,100 5,100 5,100 Pulley $7,500 7,500 7,500 7,500 7,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts