Question: Attempts Keep the Highest / 2 7. Problem 10.04 (Cost of Equity with and without Flotation) eBook Problem Walk-Through Jarett & Sons's common stock currently

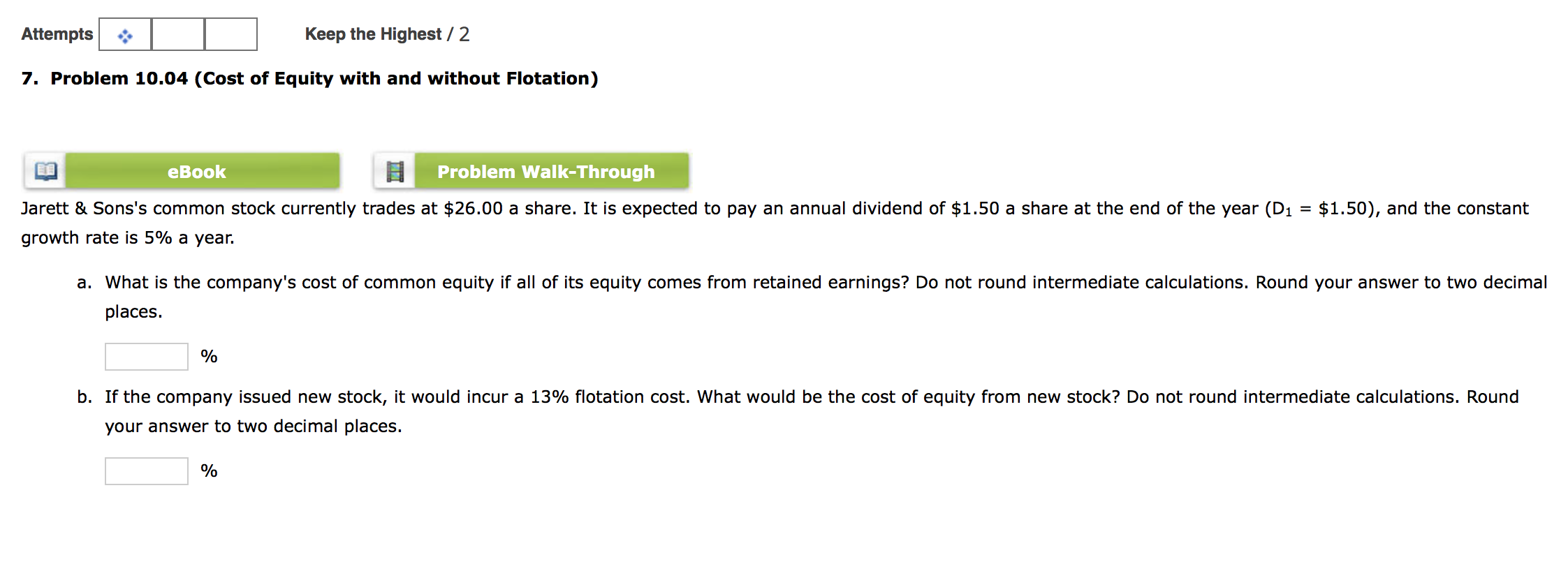

Attempts Keep the Highest / 2 7. Problem 10.04 (Cost of Equity with and without Flotation) eBook Problem Walk-Through Jarett & Sons's common stock currently trades at $26.00 a share. It is expected to pay an annual dividend of $1.50 a share at the end of the year (D1 growth rate is 5% a year. = $1.50), and the constant a. What is the company's cost of common equity if all of its equity comes from retained earnings? Do not round intermediate calculations. Round your answer to two decimal places. % b. If the company issued new stock, it would incur a 13% flotation cost. What would be the cost of equity from new stock? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts