Question: Attempts: Keep the Highest: /20 5. More on the corporate valuation model Acme Inc. is expected to generate a free cash flow (FCF) of $2,615.00

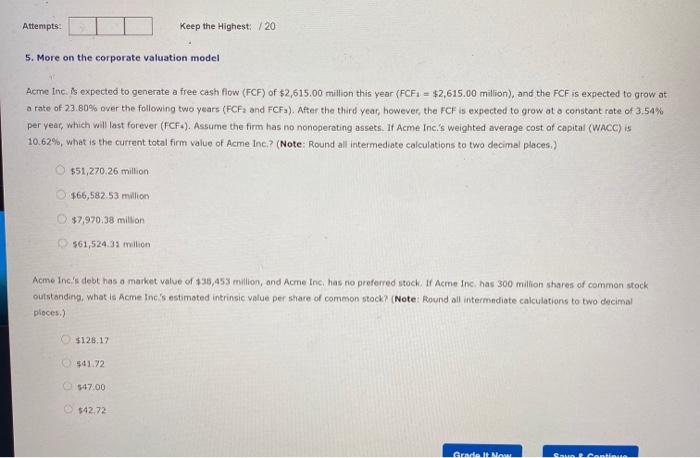

Attempts: Keep the Highest: /20 5. More on the corporate valuation model Acme Inc. is expected to generate a free cash flow (FCF) of $2,615.00 million this year (FCF1 = $2,615.00 million), and the FCF is expected to grow at a rate of 23.80% over the following two years (FCF and FCF). After the third year, however, the FCF is expected to grow at a constant rate of 3,54% per year, which will last forever (FCF-). Assume the firm has no nonoperating assets. 18 Acme Inc.'s weighted average cost of capital (WACC) is 10.62%, what is the current total firm value of Acme Inc.? (Note: Round all intermediate calculations to two decimal places.) $51,270.26 million $66,582,53 million $7.970.38 million 561,524.31 million Acme Inc.'s debt has a market value of $36,453 million, and Acme Inc. has no preferred stock. If Acme Inc. has 300 million shares of common stock outstanding, what is Acme Inc's estimated intrinsic value per share of common stock? (Note Round all intermediate calculations to two decimal places.) $128.17 $41.72 547.00 $42.72 code NON

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts