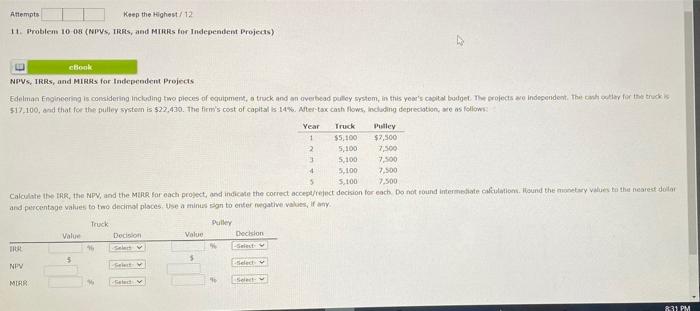

Question: Attempts Keep the Highest/12 11. Problem 10-48 (NPUS, TRRS, and MTRRs for Independent Projects) 1 cbook NPVS, TRRs, and MIRRs for Independent Projects Edelman Engineering

Attempts Keep the Highest/12 11. Problem 10-48 (NPUS, TRRS, and MTRRs for Independent Projects) 1 cbook NPVS, TRRs, and MIRRs for Independent Projects Edelman Engineering is considering including two pieces of equipment, a truck and an overbead pulley systom, in this year's capital batet The projects are independent. The choice for the trucks $17.100, and that for the pulley system is $22.430. The firm's cost of capital is 14%. After-tax cash flows, including depreciation, we as follows Year Truck Pulley 55.100 $7,500 2 5.100 7,500 5100 7500 5.100 7,500 5.100 7.500 Calculate the TRR, the NPV, and the MERR for each project, and indicate the correct accept/eject decision for each. Do not found intermediate station Hound the monetary values to the nearest door and percentage values to wo decimal places. Use a minus in to enter negative values If y Truck Pulley Value Dodaon Value Decision TR ES 1 5 5 NPV Set st MIRR 31 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts