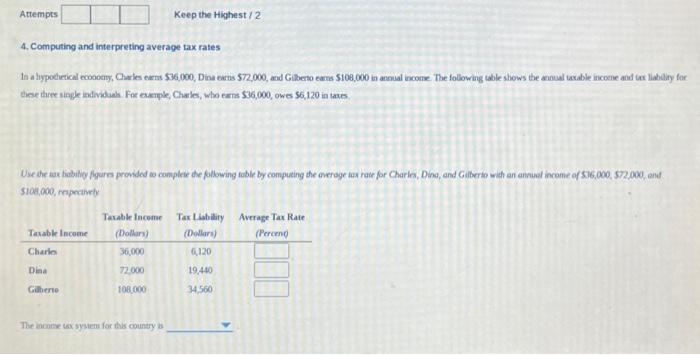

Question: Attempts Keep the Highest/2 4. Computing and interpreting average tax rates In a hypothetical economy, Charles earns $36,000, Dina earns $72,000, and Gilberto eams

Attempts Keep the Highest/2 4. Computing and interpreting average tax rates In a hypothetical economy, Charles earns $36,000, Dina earns $72,000, and Gilberto eams $108,000 in annual income. The following table shows the annual taxable income and tax liability for these three single individuals. For example, Charles, who earns $36,000, owes $6,120 in taxes Use the aux hability figures provided to complete the following table by computing the average tax rate for Charles, Dina, and Gilberto with an annual income of $36,000, $72,000, and $108,000, respectively Taxable Income Tax Liability Average Tax Rate Taxable Income (Dollars) (Dollars) (Percent) Charlo 36,000 6,120 Dina 72,000 19,440 Gilberto 108,000 34,560 The income tax system for this country i

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts