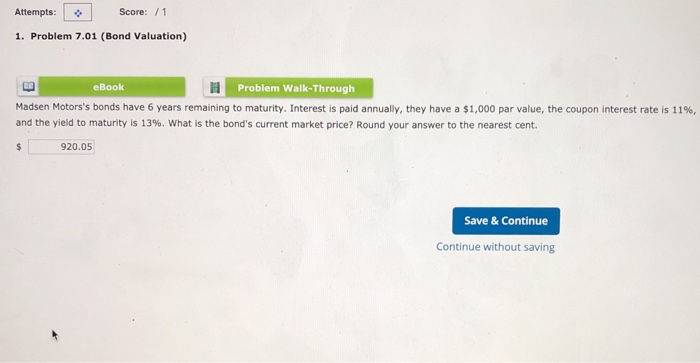

Question: Attempts: Score: / 1 1. Problem 7.01 (Bond Valuation) eBook Problem Walk-Through Madsen Motors's bonds have 6 years remaining to maturity. Interest is paid annually,

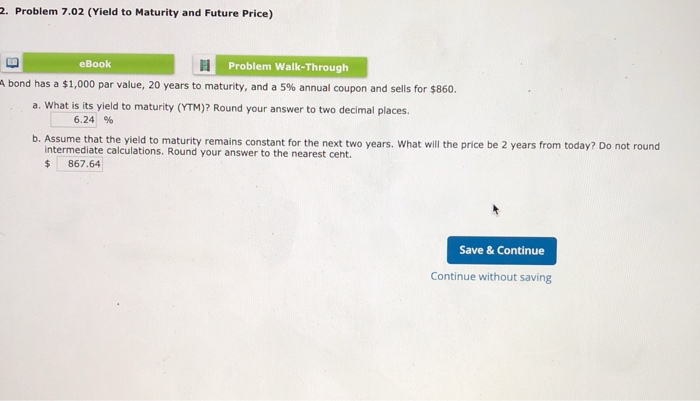

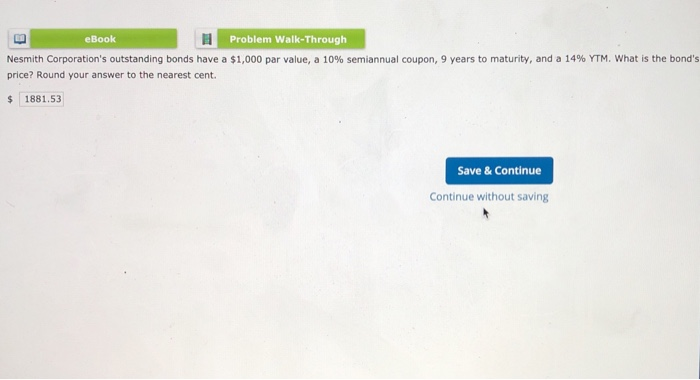

Attempts: Score: / 1 1. Problem 7.01 (Bond Valuation) eBook Problem Walk-Through Madsen Motors's bonds have 6 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 11%, and the yield to maturity is 13%. What is the bond's current market price? Round your answer to the nearest cent. 920.05 $ Save & Continue Continue without saving 2. Problem 7.02 (Yield to Maturity and Future Price) eBook Problem Walk-Through Abond has a $1,000 par value, 20 years to maturity, and a 5% annual coupon and sells for $860. a. What is its yield to maturity (YTM)? Round your answer to two decimal places. 6.24 % b. Assume that the yield to maturity remains constant for the next two years. What will the price be 2 years from today? Do not round intermediate calculations. Round your answer to the nearest cent. 867.64 $ Save & Continue Continue without saving eBook Problem Walk-Through Nesmith Corporation's outstanding bonds have a $1,000 par value, a 10% semiannual coupon, 9 years to maturity, and a 14% YTM. What is the bond's price? Round your answer to the nearest cent. $ 1881.53 Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts