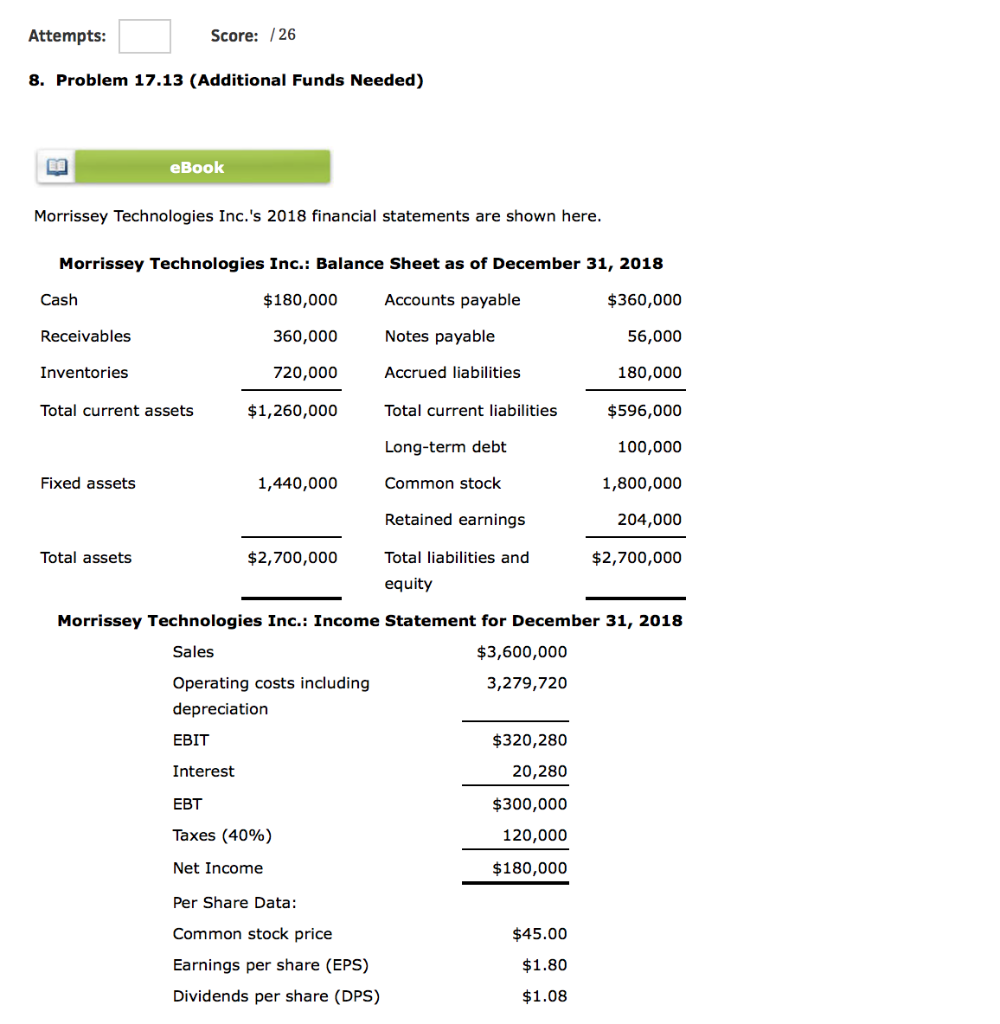

Question: Attempts Score: /26 8. Problem 17.13 (Additional Funds Needed) eBook Morrissey Technologies Inc.'s 2018 financial statements are shown here Morrissey Technologies Inc.: Balance Sheet as

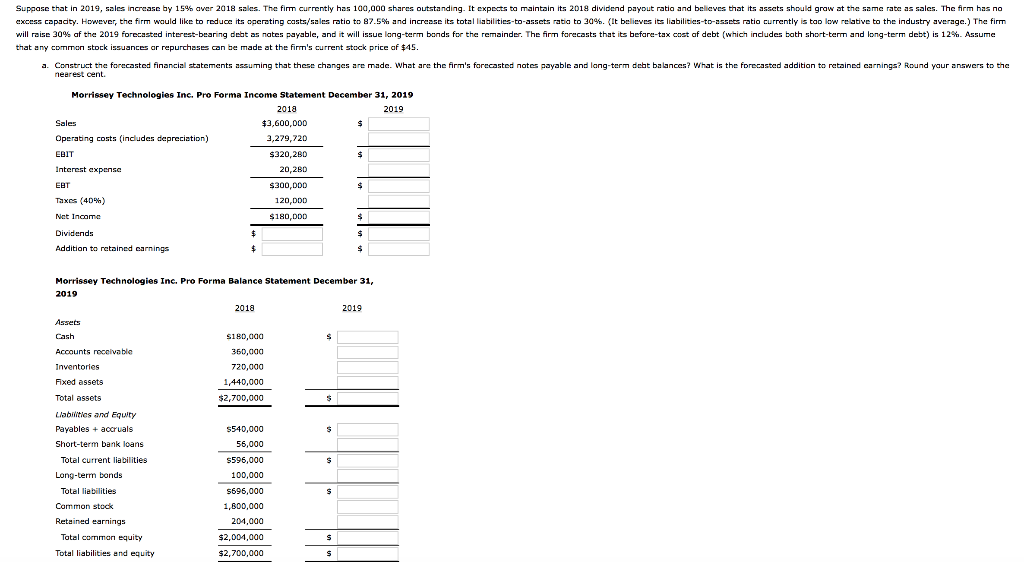

Attempts Score: /26 8. Problem 17.13 (Additional Funds Needed) eBook Morrissey Technologies Inc.'s 2018 financial statements are shown here Morrissey Technologies Inc.: Balance Sheet as of December 31, 2018 Cash Receivables Inventories Total current assets $180,000 360,000 720,000 $1,260,000 Accounts payable Notes payable Accrued liabilities Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $360,000 56,000 180,000 $596,000 100,000 1,800,000 204,000 $2,700,000 Fixed assets 1,440,000 Total assets $2,700,000 Morrissey Technologies Inc.: Income Statement for December 31, 2018 Sales Operating costs including depreciation EBIT Interest EBT Taxes (40%) Net Income Per Share Data Common stock price Earnings per share (EPS) Dividends per share (DPS) $3,600,000 3,279,720 $320,280 20,280 $300,000 120,000 $180,000 $45.00 $1.80 $1.08 Suppasc that in 2019, sales increase by 15% aver 2018 sales. The firm currently has 1aa,000 shares outstanding. It expects ta maintain its 2019 dividend payout ratia and believes that its asscts should graw at the same rate as sales. The firm has no excess capaaty. However the fir would like to reduce its operating casts sales r tio to 87.5% and increase its total liabilities o assets aba to 3% t believes its liabili es-to-assets ratio currently is ao low elabve to the industry average. The firm will rise 30% af the 2019 forecasted interest-bear ng debt as nates payable, and it will issue long-term bonds for the remainder. The firm farecasts that its be are tax cost af debt which Inc udes bath short-term and long-term debt is 129 Assu e that my common stock issuances ar repurchases can e made at the firm's current stock price af 45. Construct tnforecasted financial statements assuming that these changes are made. What are the fir neerest cent. s arecasted notesayable and ang-term debt balances? what is the recasted additian to retained earnings? Round yaur swers to the Morrissey Technologies Inc. Pro Forma Income Statement December 31, 2019 2018 2019 $3,600,000 3,279,720 320,280 20,2BD 300,DD 120,DDD 180,DDD Operating costs (indludes depreciation) ntercat expenso EBT Taxes (4D%) Addition to retained carnings Morrissey Technologies Inc. Pro Forma Balanc@ Statement Dc@mber 31, 2019 2018 2019 Assets Cash Accounts roccivable S180,aa 360,aaa 720,000 1440,000 $2,700,000 Fxed assets Total assets Liabitios and Eqwry Payables +accruals Short-term bank loans S540,000 56,000 S596,000 100,000 S696,000 1,B00,000 201,000 $2,004,000 $2,700,000 Total current labilties Long-tern bonds Total liebilities Common stock Retained earnings Total common equity Total liabilities and equity b. If the profit margin remains at 5% and the dividend payout ratio remains at 60%, at what growth rate in sales will the additional financing requirements be exactly zero? In other words, what is the firm's sustainable growth rate? (Hint: 5e AFN equal to zero and solve for g.) Round your answer to two decimal places. Attempts Score: /26 8. Problem 17.13 (Additional Funds Needed) eBook Morrissey Technologies Inc.'s 2018 financial statements are shown here Morrissey Technologies Inc.: Balance Sheet as of December 31, 2018 Cash Receivables Inventories Total current assets $180,000 360,000 720,000 $1,260,000 Accounts payable Notes payable Accrued liabilities Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $360,000 56,000 180,000 $596,000 100,000 1,800,000 204,000 $2,700,000 Fixed assets 1,440,000 Total assets $2,700,000 Morrissey Technologies Inc.: Income Statement for December 31, 2018 Sales Operating costs including depreciation EBIT Interest EBT Taxes (40%) Net Income Per Share Data Common stock price Earnings per share (EPS) Dividends per share (DPS) $3,600,000 3,279,720 $320,280 20,280 $300,000 120,000 $180,000 $45.00 $1.80 $1.08 Suppasc that in 2019, sales increase by 15% aver 2018 sales. The firm currently has 1aa,000 shares outstanding. It expects ta maintain its 2019 dividend payout ratia and believes that its asscts should graw at the same rate as sales. The firm has no excess capaaty. However the fir would like to reduce its operating casts sales r tio to 87.5% and increase its total liabilities o assets aba to 3% t believes its liabili es-to-assets ratio currently is ao low elabve to the industry average. The firm will rise 30% af the 2019 forecasted interest-bear ng debt as nates payable, and it will issue long-term bonds for the remainder. The firm farecasts that its be are tax cost af debt which Inc udes bath short-term and long-term debt is 129 Assu e that my common stock issuances ar repurchases can e made at the firm's current stock price af 45. Construct tnforecasted financial statements assuming that these changes are made. What are the fir neerest cent. s arecasted notesayable and ang-term debt balances? what is the recasted additian to retained earnings? Round yaur swers to the Morrissey Technologies Inc. Pro Forma Income Statement December 31, 2019 2018 2019 $3,600,000 3,279,720 320,280 20,2BD 300,DD 120,DDD 180,DDD Operating costs (indludes depreciation) ntercat expenso EBT Taxes (4D%) Addition to retained carnings Morrissey Technologies Inc. Pro Forma Balanc@ Statement Dc@mber 31, 2019 2018 2019 Assets Cash Accounts roccivable S180,aa 360,aaa 720,000 1440,000 $2,700,000 Fxed assets Total assets Liabitios and Eqwry Payables +accruals Short-term bank loans S540,000 56,000 S596,000 100,000 S696,000 1,B00,000 201,000 $2,004,000 $2,700,000 Total current labilties Long-tern bonds Total liebilities Common stock Retained earnings Total common equity Total liabilities and equity b. If the profit margin remains at 5% and the dividend payout ratio remains at 60%, at what growth rate in sales will the additional financing requirements be exactly zero? In other words, what is the firm's sustainable growth rate? (Hint: 5e AFN equal to zero and solve for g.) Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts