Question: Attention! No explanation is needed. Answer all four questions. ( Not only one because based on your policy I can ask up to four questions

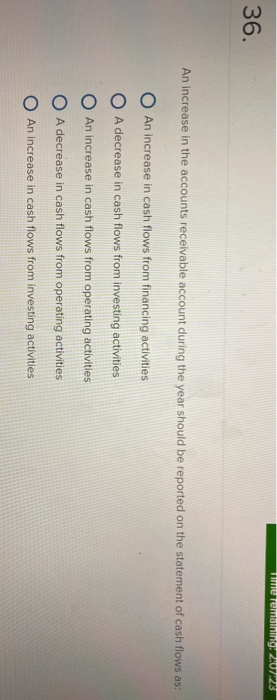

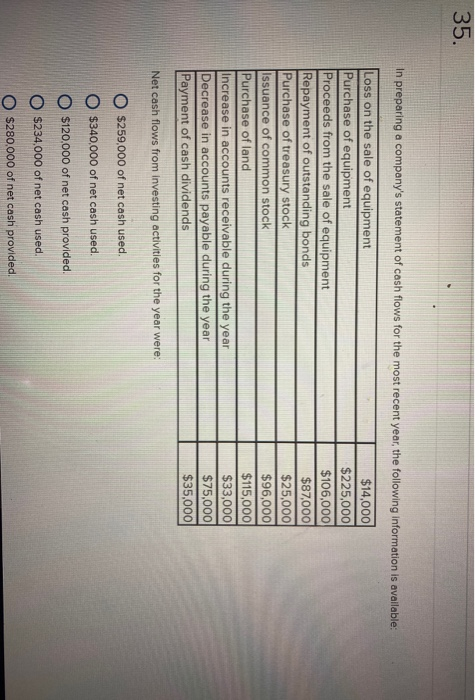

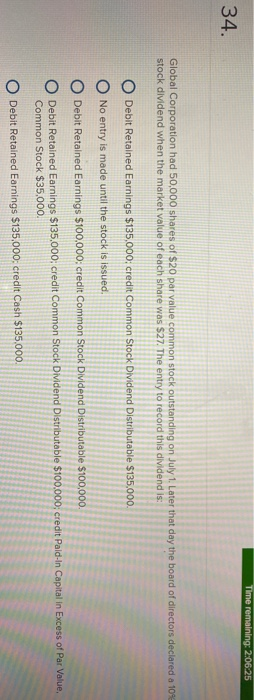

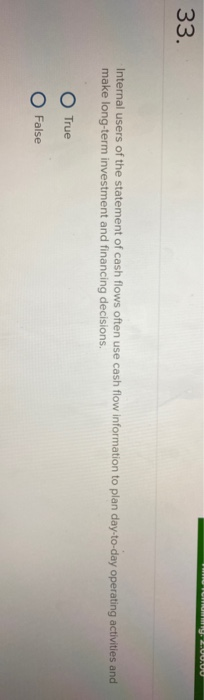

Tire remaining: 2:07:23 36. An increase in the accounts receivable account during the year should be reported on the statement of cash flows as: An increase in cash flows from financing activities A decrease in cash flows from investing activities An increase in cash flows from operating activities A decrease in cash flows from operating activities O An increase in cash flows from investing activities 35. In preparing a company's statement of cash flows for the most recent year, the following information is available: Loss on the sale of equipment Purchase of equipment Proceeds from the sale of equipment Repayment of outstanding bonds Purchase of treasury stock Issuance of common stock Purchase of land Increase in accounts receivable during the year Decrease in accounts payable during the year Payment of cash dividends $14,000 $225,000 $106,000 $87,000 $25,000 $96,000 $115,000 $33,000 $75,000 $35,000 Net cash flows from investing activities for the year were: $259,000 of net cash used. $340,000 of net cash used $120,000 of net cash provided $234,000 of net cash used. $280,000 of net cash provided Time remaining: 2:06:25 34. Global Corporation had 50,000 shares of S20 par value common stock outstanding on July 1. Later that day the board of directors declared a 10% stock dividend when the market value of each share was $27. The entry to record this dividend is: Debit Retained Earnings $135,000; credit Common Stock Dividend Distributable $135,000 No entry is made until the stock is issued. Debit Retained Earnings $100,000: credit Common Stock Dividend Distributable $100,000 Debit Retained Earnings $135,000, credit Common Stock Dividend Distributable $100,000; credit Pald-In Capital in Excess of Par Value, Common Stock $35.000. Debit Retained Earnings $135,000; credit Cash $135,000. WWW.UUUU 33. Internal users of the statement of cash flows often use cash flow information to plan day-to-day operating activities and make long-term investment and financing decisions. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts