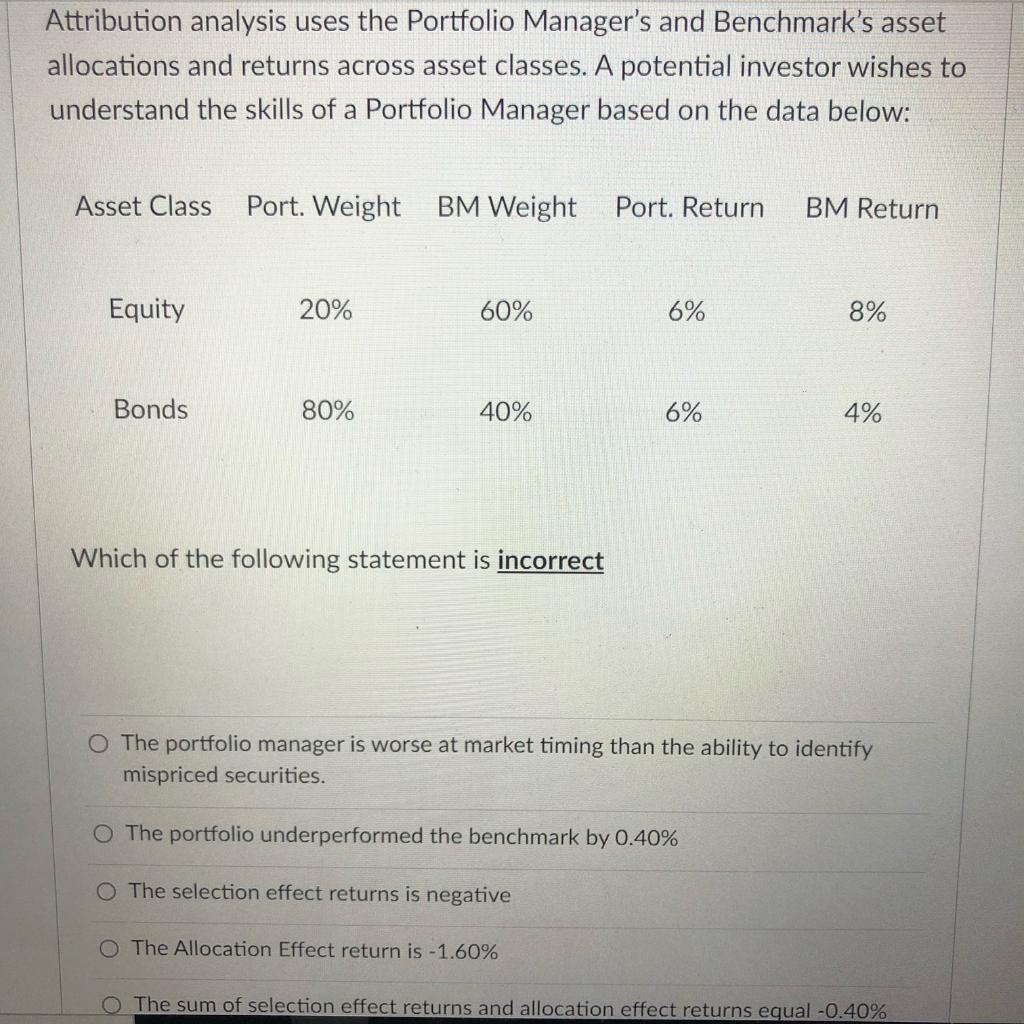

Question: Attribution analysis uses the Portfolio Manager's and Benchmark's asset allocations and returns across asset classes. A potential investor wishes to understand the skills of a

Attribution analysis uses the Portfolio Manager's and Benchmark's asset allocations and returns across asset classes. A potential investor wishes to understand the skills of a Portfolio Manager based on the data below: Asset Class Port. Weight BM Weight Port. Return BM Return Equity 20% 60% 6% 8% Bonds 80% 40% 6% 4% Which of the following statement is incorrect O The portfolio manager is worse at market timing than the ability to identify mispriced securities. O The portfolio underperformed the benchmark by 0.40% O The selection effect returns is negative O The Allocation Effect return is -1.60% O The sum of selection effect returns and allocation effect returns equal -0.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts