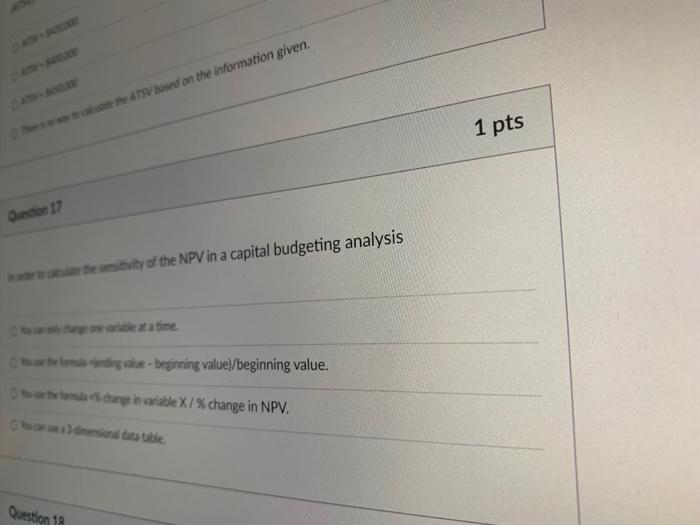

Question: ATV based on the information given. 1 pts Question 17 the sensitivity of the NPV in a capital budgeting analysis ble tatime. werdening value-beginning value)/beginning

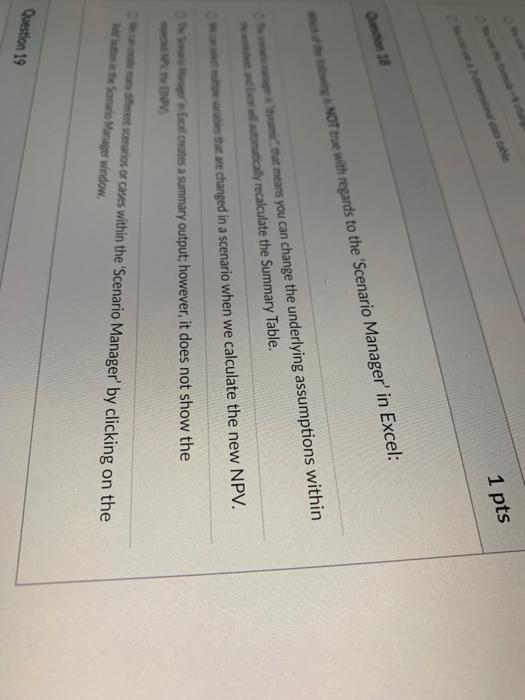

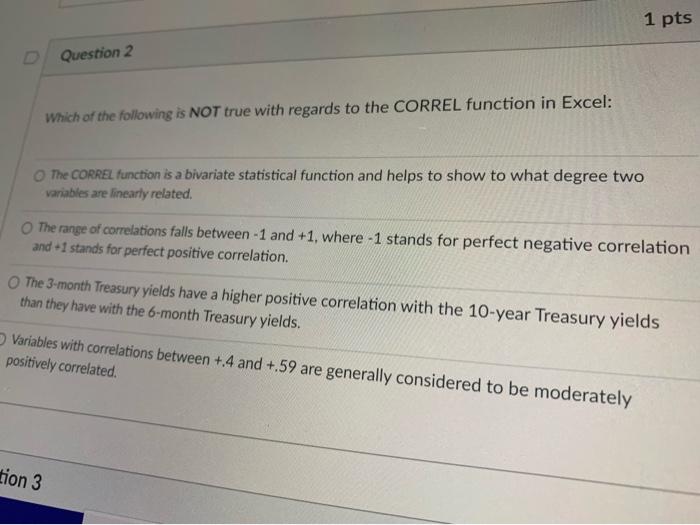

ATV based on the information given. 1 pts Question 17 the sensitivity of the NPV in a capital budgeting analysis ble tatime. werdening value-beginning value)/beginning value. habendange in variable X/% change in NPV. Obodenini datatable Question 18 1 pts Question 18 NOT true with regards to the 'Scenario Manager' in Excel: On that means you can change the underlying assumptions within bet tomatically recalculate the Summary Table. les that are changed in a scenario when we calculate the new NPV. relates a summary output; however, it does not show the the enties or cases within the Scenario Manager' by clicking on the Sorario Manager window Question 19 1 pts D Question 2 Which of the following is NOT true with regards to the CORREL function in Excel: The CORREL function is a bivariate statistical function and helps to show to what degree two variables are linearly related. The range of correlations falls between-1 and +1, where -1 stands for perfect negative correlation and + 1 stands for perfect positive correlation. The 3-month Treasury yields have a higher positive correlation with the 10-year Treasury yields than they have with the 6-month Treasury yields. Variables with correlations between +.4 and +,59 are generally considered to be moderately positively correlated tion 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts