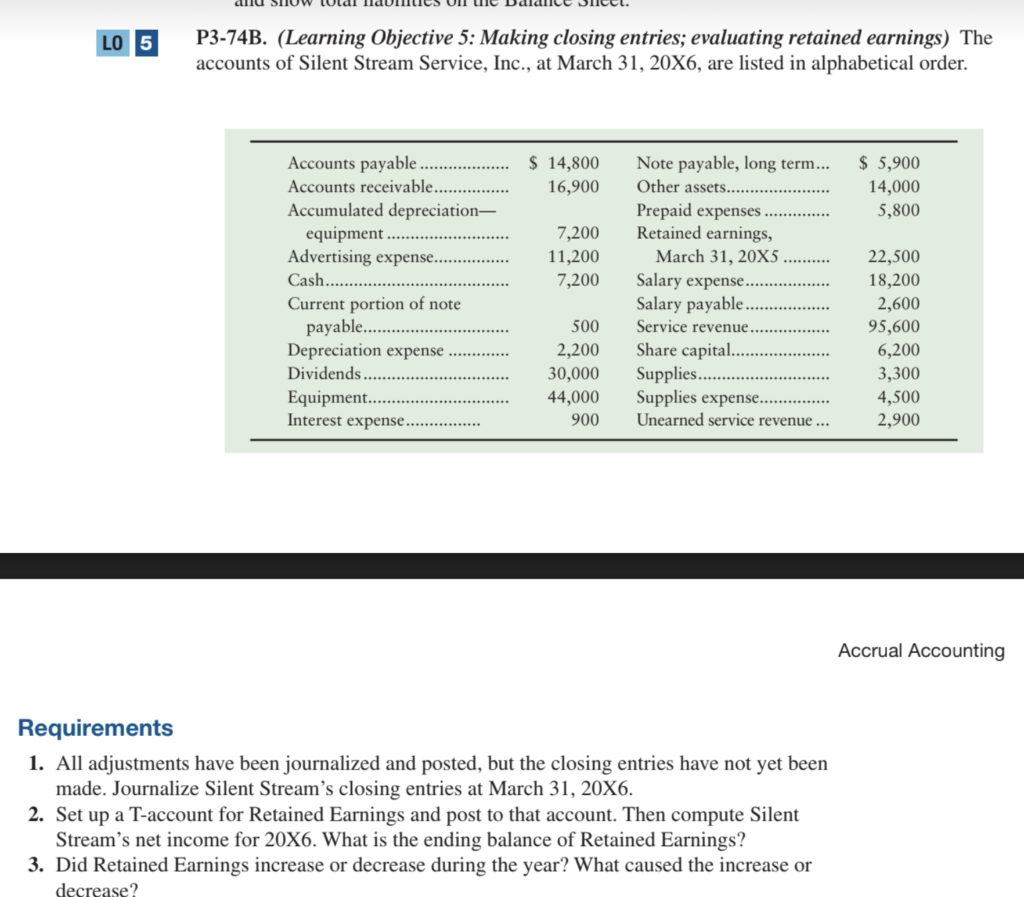

Question: AU SUUW LO 5 P3-74B. (Learning Objective 5: Making closing entries; evaluating retained earnings) The accounts of Silent Stream Service, Inc., at March 31, 20X6,

AU SUUW LO 5 P3-74B. (Learning Objective 5: Making closing entries; evaluating retained earnings) The accounts of Silent Stream Service, Inc., at March 31, 20X6, are listed in alphabetical order. $ 14,800 16,900 $ 5,900 14,000 5,800 7,200 11,200 7,200 Accounts payable Accounts receivable. Accumulated depreciation- equipment Advertising expense..... Cash.... Current portion of note payable. Depreciation expense ...... Dividends. Equipment.... Interest expense.............. Note payable, long term... Other assets... Prepaid expenses Retained earnings, March 31, 20X5 Salary expense.. Salary payable. Service revenue Share capital.... Supplies... Supplies expense..... Unearned service revenue ... 500 2,200 30,000 44,000 900 22,500 18,200 2,600 95,600 6,200 3,300 4,500 2,900 Accrual Accounting Requirements 1. All adjustments have been journalized and posted, but the closing entries have not yet been made. Journalize Silent Stream's closing entries at March 31, 20X6. 2. Set up a T-account for Retained Earnings and post to that account. Then compute Silent Streams net income for 20X6. What is the ending balance of Retained Earnings? 3. Did Retained Earnings increase or decrease during the year? What caused the increase or decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts