Question: Audit and Assurance Question - Ethic issue Integrity, Objectivity, Professional competence and duty care, Professional behavior, Confidentiality.... Self-interest threat, self-review threat, familiarity.... Question 1 Answer

Audit and Assurance Question - Ethic issue

Integrity, Objectivity, Professional competence and duty care, Professional behavior, Confidentiality....

Self-interest threat, self-review threat, familiarity....

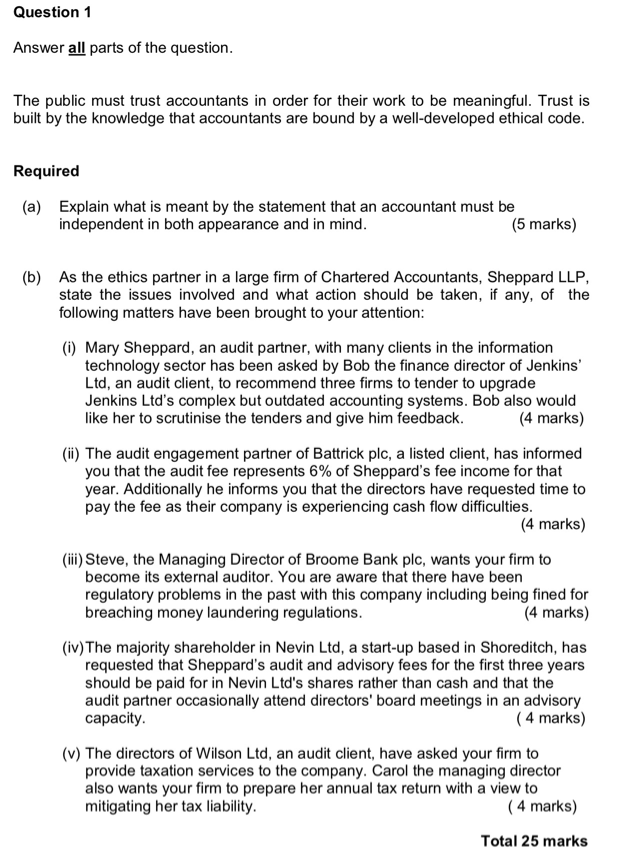

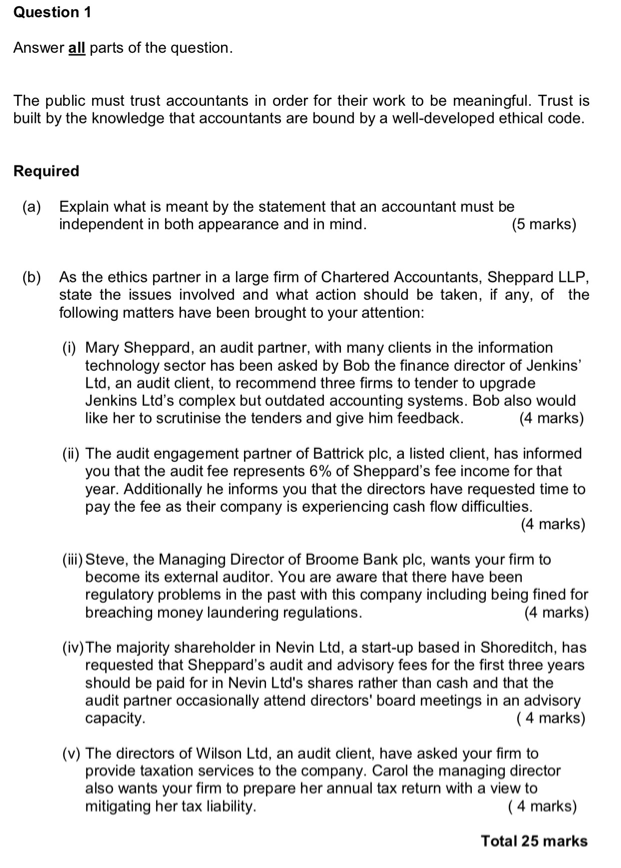

Question 1 Answer all parts of the question. The public must trust accountants in order for their work to be meaningful. Trust is built by the knowledge that accountants are bound by a well-developed ethical code. Required (a) Explain what is meant by the statement that an accountant must be independent in both appearance and in mind. (5 marks) (b) As the ethics partner in a large firm of Chartered Accountants, Sheppard LLP state the issues involved and what action should be taken, if any, of the following matters have been brought to your attention: (i) Mary Sheppard, an audit partner, with many clients in the information technology sector has been asked by Bob the finance director of Jenkins' Ltd, an audit client, to recommend three firms to tender to upgrade Jenkins Ltd's complex but outdated accounting systems. Bob also would like her to scrutinise the tenders and give him feedback. (4 marks) (ii) The audit engagement partner of Battrick plc, a listed client, has informed you that the audit fee represents 6% of Sheppard's fee income for that year. Additionally he informs you that the directors have requested time to pay the fee as their company is experiencing cash flow difficulties. (4 marks) (iii) Steve, the Managing Director of Broome Bank pic, wants your firm to become its external auditor. You are aware that there have been regulatory problems in the past with this company including being fined for breaching money laundering regulations. (4 marks) (iv) The majority shareholder in Nevin Ltd, a start-up based in Shoreditch, has requested that Sheppard's audit and advisory fees for the first three years should be paid for in Nevin Lid's shares rather than cash and that the audit partner occasionally attend directors' board meetings in an advisory capacity. ( 4 marks) (v) The directors of Wilson Lid, an audit client, have asked your firm to provide taxation services to the company. Carol the managing director also wants your firm to prepare her annual tax return with a view to mitigating her tax liability. ( 4 marks) Total 25 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts